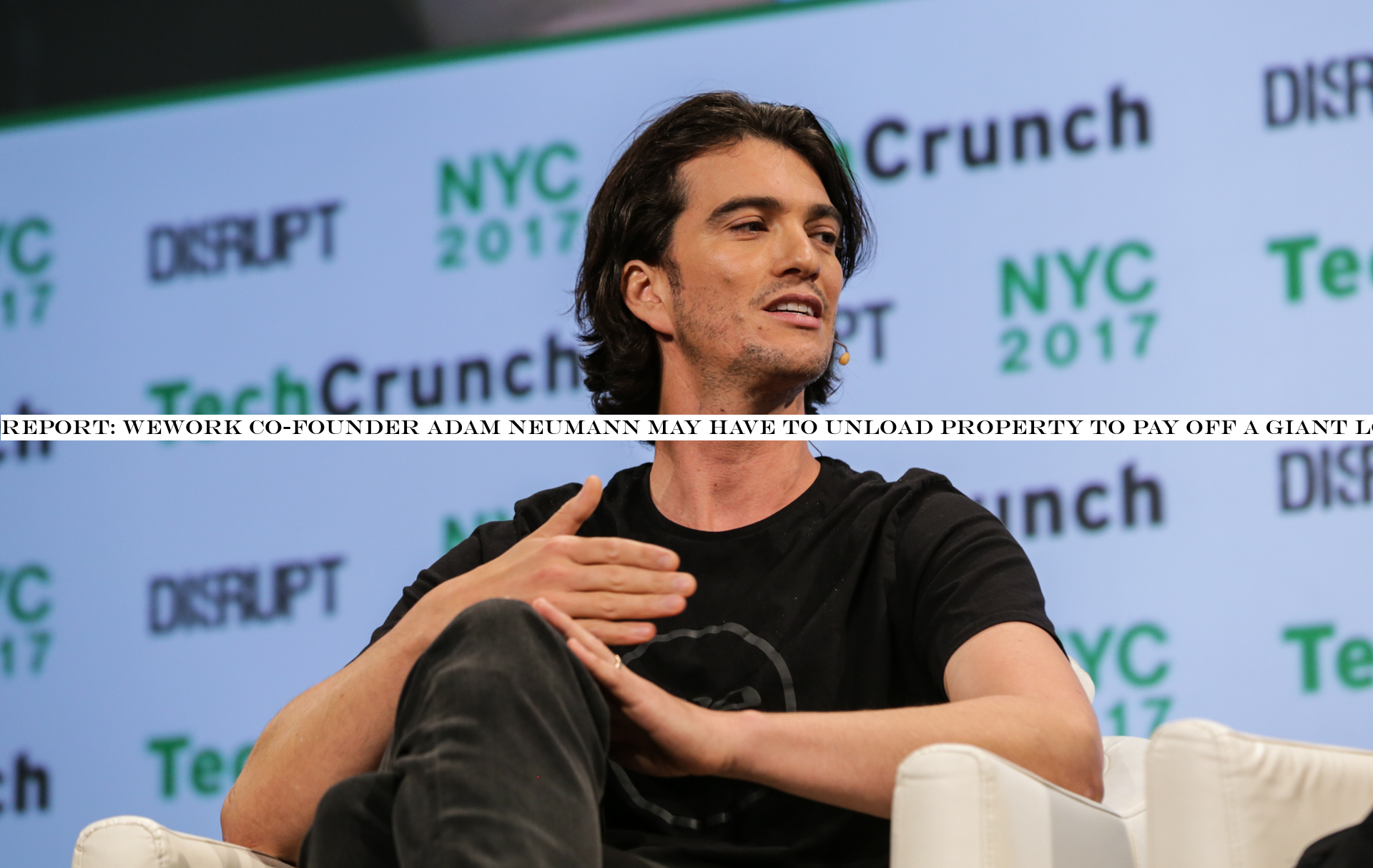

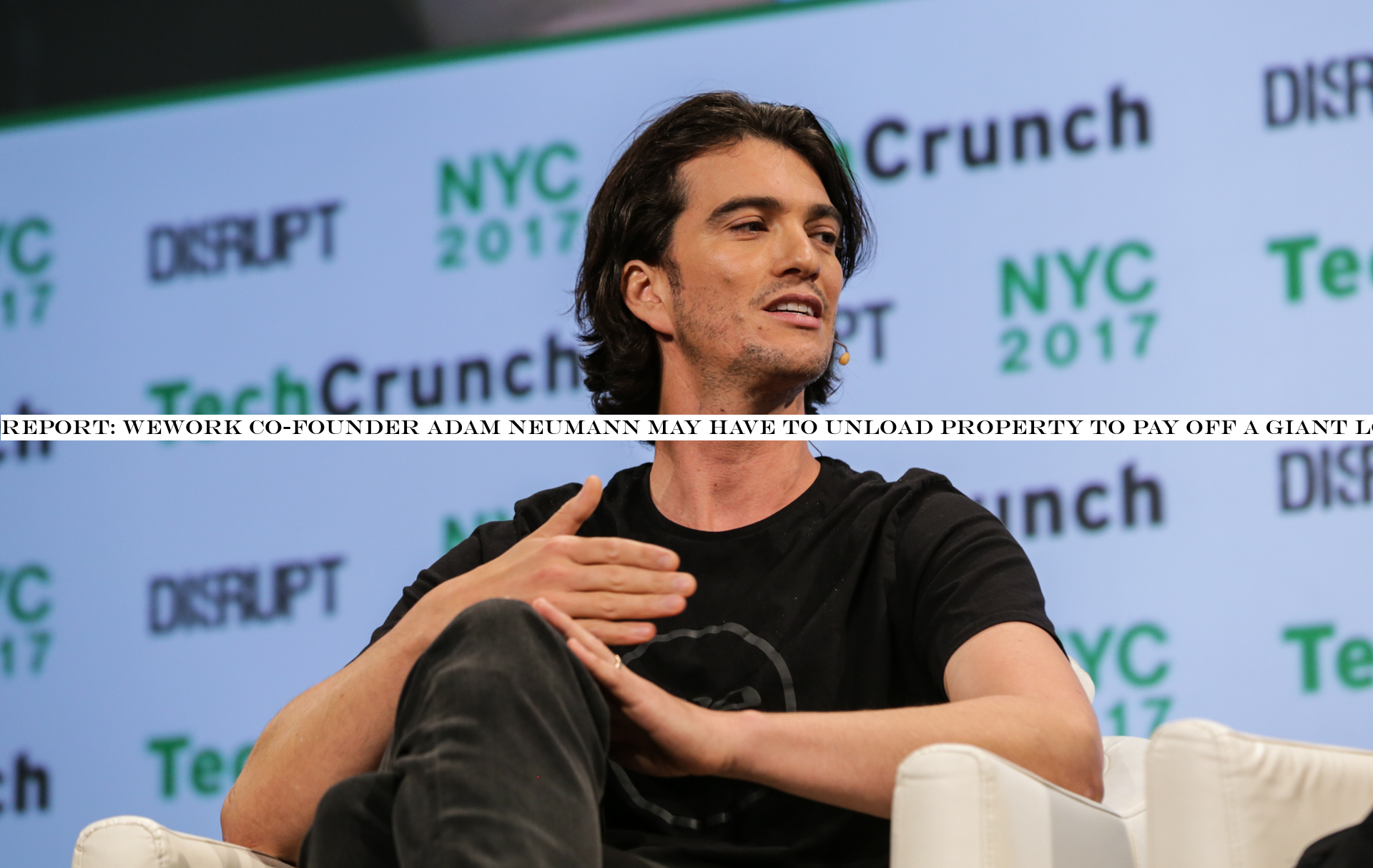

INSUBCONTINENT EXCLUSIVE:

new Business Insider piece, Neumann is working with JPMorgan, UBS and Credit Suisse to consider new terms for a $500 million loan that he

took out before WeWork filed to go public, and from which Neumann has already drawn down $380 million

Because he can no longer pay the loan with proceeds from selling WeWork shares publicly (it yanked its S-1 filing earlier this week), he may

a spokeswoman for Neumann tells the outlet.Per earlier reports, Neumann has plenty to offload if it comes to it, having acquired numerous

residential and commercial properties over the years.Among his reported investments is a $10.5 million Greenwich Village townhouse; a farm

in Westchester, New York; a home in the Hamptons, where he reportedly weathered the storm with his family ahead of resigning as CEO last

week; and a $21 million, 13,000-square-foot house in the Bay Area with a guitar-shaped room.According to an earlier WSJ report, Neumann also

bought several commercial properties through investor groups that he leased back, in some cases, to WeWork.WeWork and Neumann have both

enjoyed a close relationship with JPMorgan in recent years

Neumann money personally (with his inflated shares as collateral), provided equity and debt for the company, served as a corporate adviser