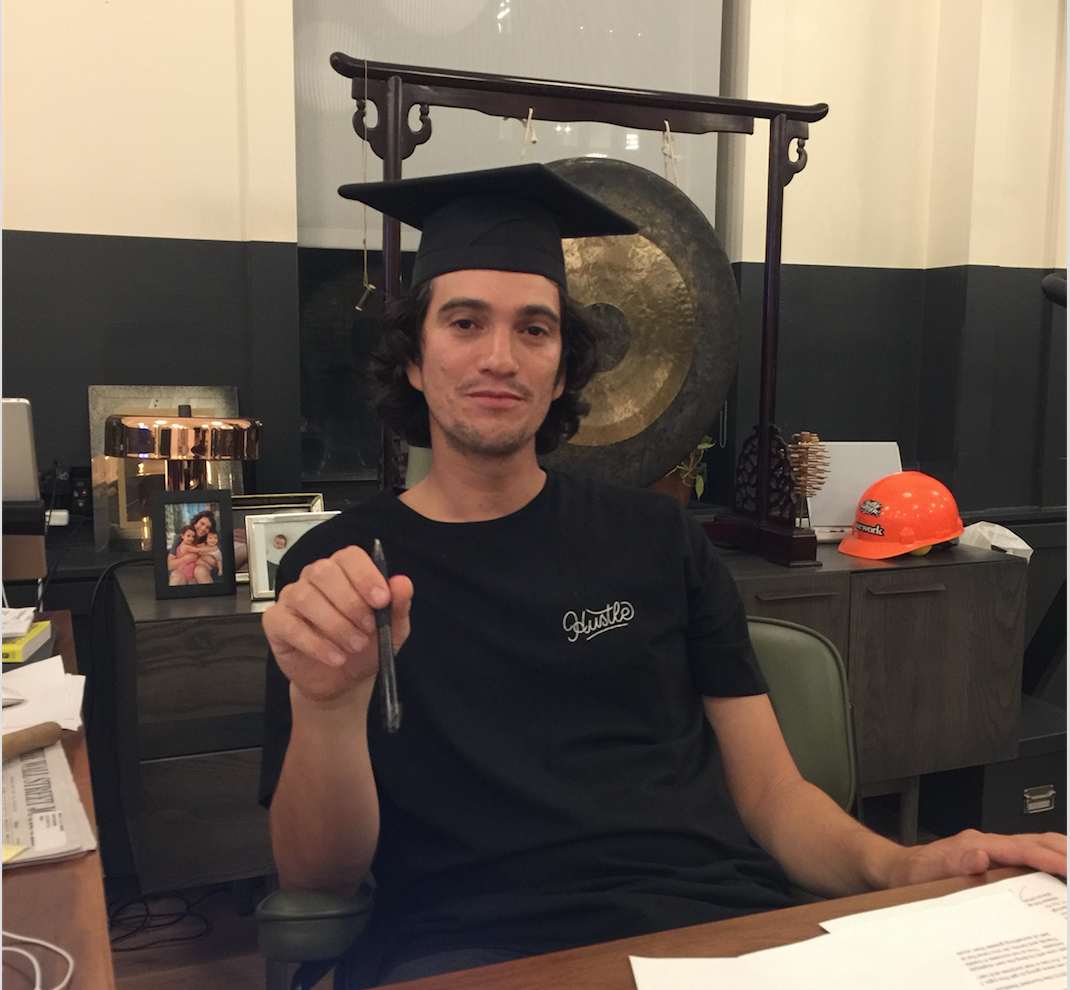

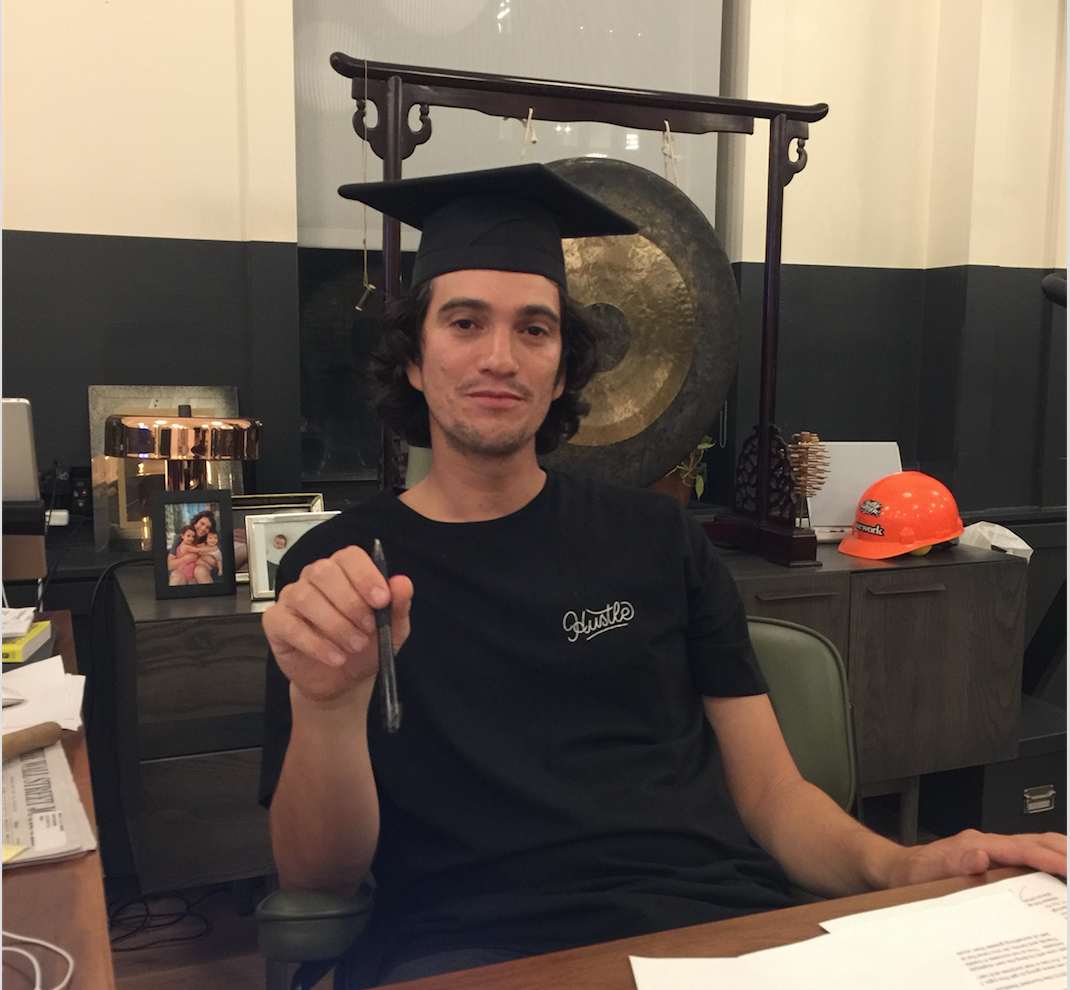

INSUBCONTINENT EXCLUSIVE:

After erasing more than $30 billion in projected shareholder value, Adam Neumann could walk away from the We Company with a windfall of as

much as $1.7 billion, according to a report in The Wall Street Journal.This is how the company will end, not with the pop of a successful

public offering, but with a whimper from defeated investors probably tired after the months-long saga of trying to make sense of how a

executive, Neumann controlled shares of the company that gave him what amounted to significant control even after his removal.The We Company

Even if it was ultimately a capitalism that was conscious only of its ability to deceive.As Neumann leaves, SoftBank will gain control of

the company it had once valued at $47 billion, but at a far more modest $8 billion figure

the company he co-founded as public markets balked over his managerial acumen

The Japanese conglomerate, which had pushed up the private market valuation of WeWork through its $100 billion Vision Fund, will also stake

Neumann $500 million in credit to repay a loan facility and give him a $185 million consulting fee

As a result, Neumann will now be on the hook to Softbank for the loan.Even with the Hindenburg-level catastrophe that Neumann piloted as the

chief executive of the money-losing real estate venture, the former chief executive will still retain a stake in the company and remain an

In fact, WeWork needs the money to be able to afford the layoffs it reportedly wants to make as it tries to right the ship.People with

Despite financials that showed losses of nearly $1 billion in the six months ending June 30, the company still managed to accumulate a

While our business has never been stronger, in recent weeks, the scrutiny directed toward me has become a significant distraction, and I

have decided that it is in the best interest of the company to step down as chief executive