INSUBCONTINENT EXCLUSIVE:

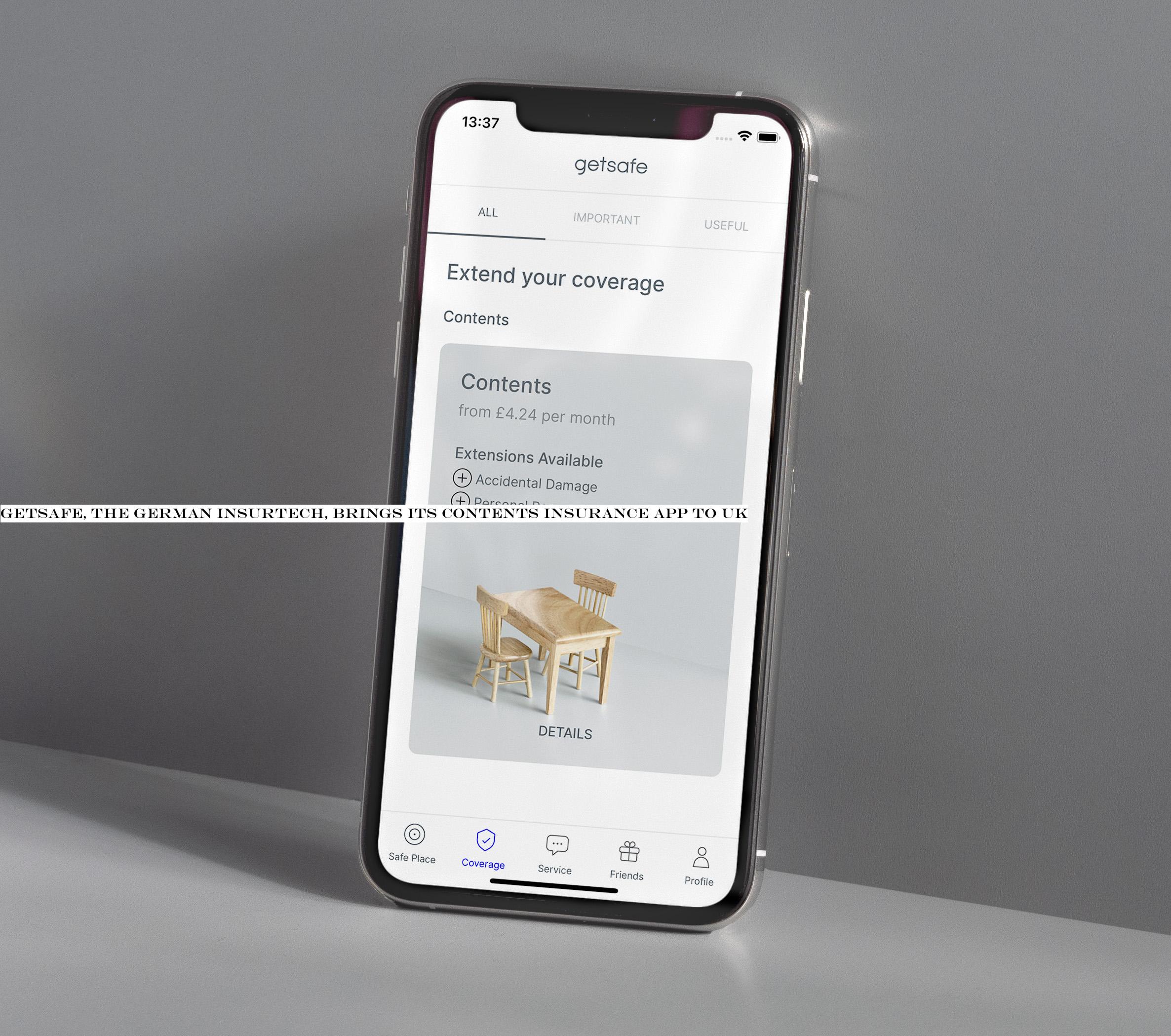

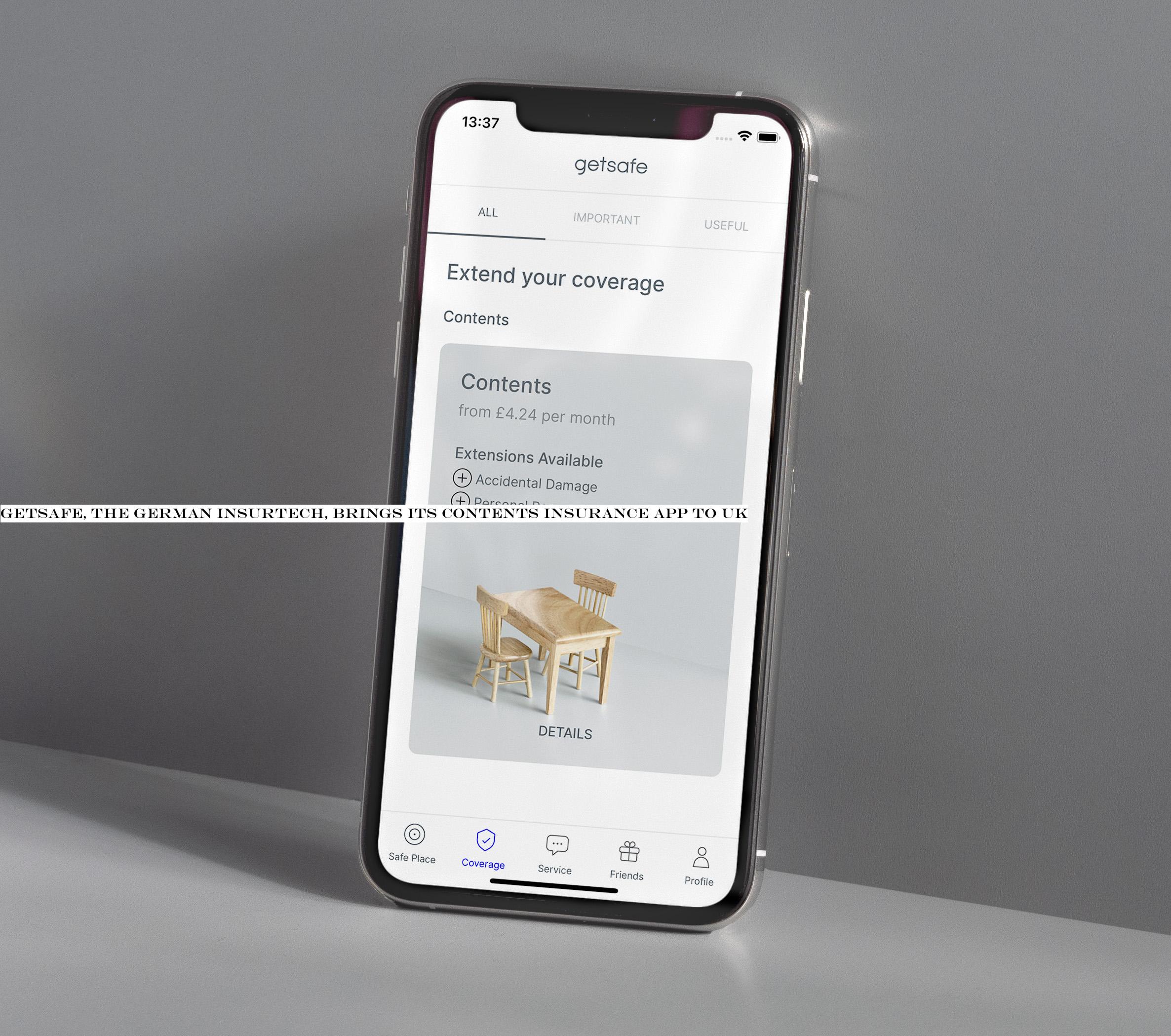

Getsafe, the German insurtech that offers home contents insurance via an app, has launched in the U.K., despite an increasingly competitive

market for insurance in the country, and the thorny regulatory issue of Brexit.This has seen Getsafe incorporate an independent British

subsidiary based in London, in order to shield it ahead of future political decisions about the future trading relationship between the U.K

and the European Union.To launch its flagship home contents insurance in the U.K., the startup has also partnered with with Hiscox

It currently partners with Munich Re and AXA for other markets.

Founded in May 2015 by Christian Wiens and Marius Blaesing in Heidelberg,

Getsafe initially launched as a digital insurance broker before pivoting to a direct to consumer insurance offering of its own (its

possessions cover (which insures possessions out of home) and accidental damage cover

The idea is that you build and only pay for the exact cover you need.Earlier this week, I took the Getsafe on-boarding process for a spin

and signed up for basic home contents insurance

To do this, Getsafe has developed a claims chatbot called Carla, who is available 24 hours a day to answer questions and report claims

is an attractive market (despite Brexit) because consumers are used to buying financial products digitally

Revolut, Starling and N26 are well-established

In contrast, he argues that insurance is yet to catch up

The round was led by Earlybird, with participation from CommerzVentures (and other existing investors).