INSUBCONTINENT EXCLUSIVE:

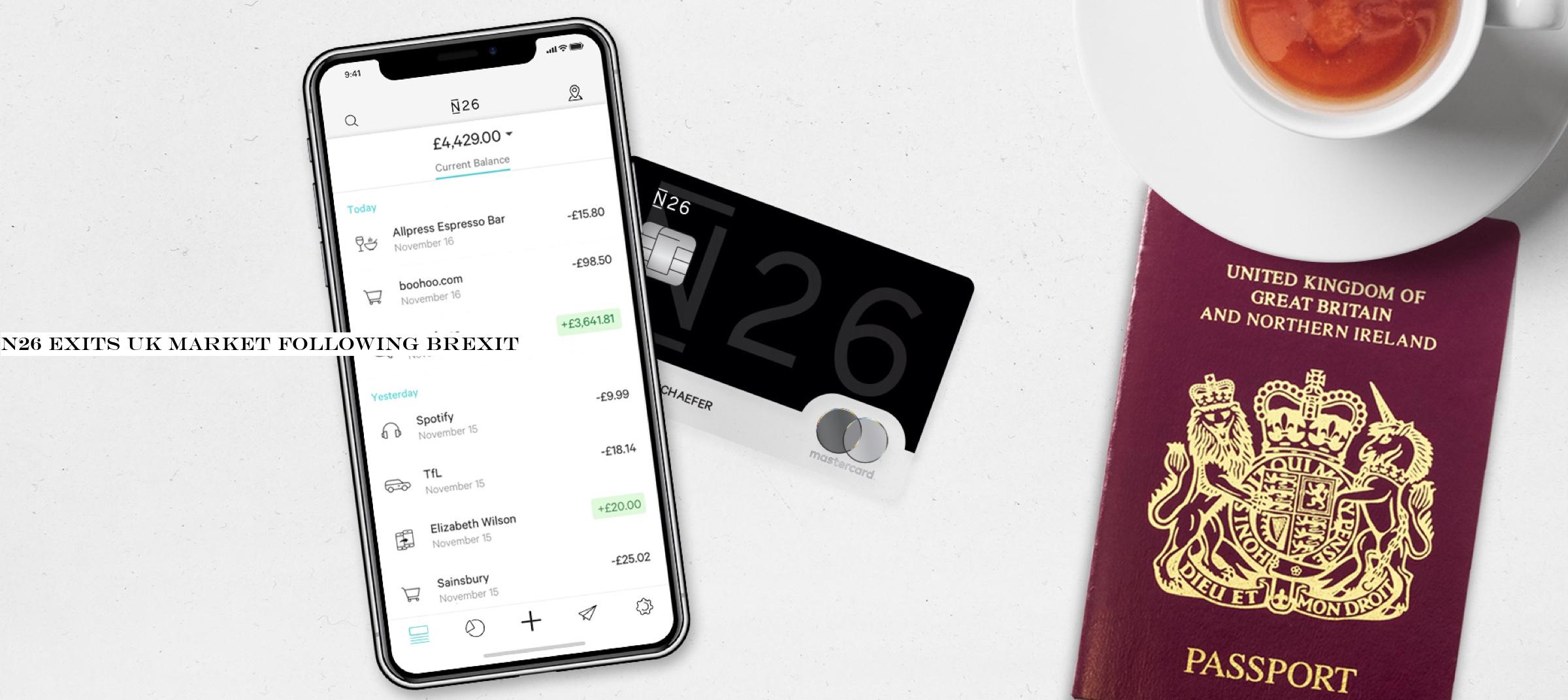

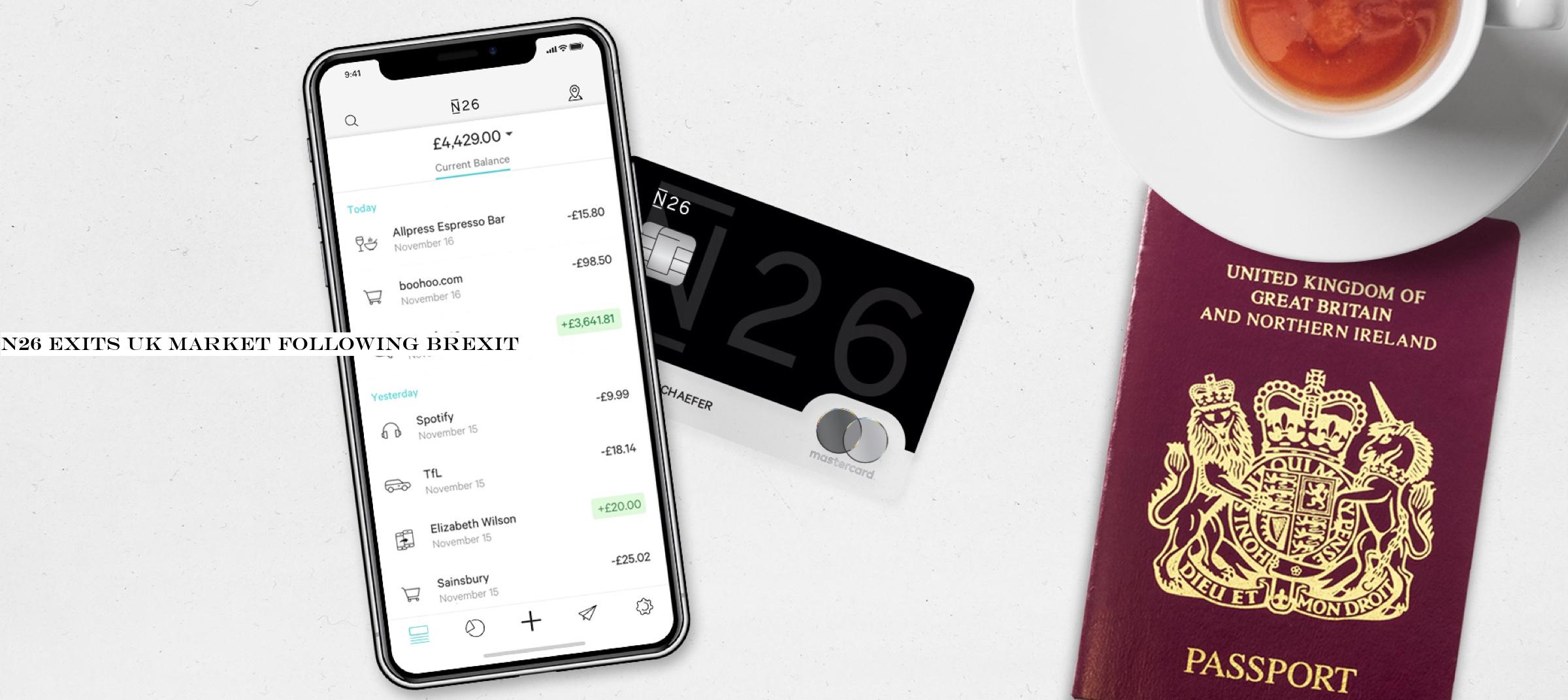

German fintech startup N26 is shutting down its operations in the U.K

Customers who opened a bank account in the U.K

will have to transfer their deposits, spend everything with their card or withdraw money at an ATM, as all accounts will be automatically

closed on April 15, 2020.Many European fintech companies take advantage of a European process called passporting

It lets you apply for a license to operate as a bank or a financial service in an EU member state and then expand to all EU member states.As

you may have guessed, N26 has to exit from the U.K

banking market because it currently has a European banking license through the central bank of Germany

Passporting is going to change following Brexit.In particular, European companies that operate in the U.K

outlined in the EU Withdrawal Agreement mean that the company will in due course be unable to operate in the UK with its European banking

from Monzo, Starling and in some ways Revolut

with its own banking license.You can no longer sign up in the U.K

You should empty your bank account, move your recurring payments to another bank, identify all your subscriptions, direct debits and

Your card will be deactivated

Direct debits and deposits will bounce as well

If you have a premium subscription, N26 is going to stop charging you for your N26 You or N26 Metal subscription from March 14.