INSUBCONTINENT EXCLUSIVE:

VC firm TLcom Capital closed its Tide Africa Fund at $71 million in February, and announced plans to invest in 12 startups over the next 18

months.

The group — with offices in London, Lagos and Nairobi — is looking for tech-enabled, revenue-driven ventures in Africa from

seed-stage to Series B, according to TLcom Managing PartnerMaurizio Caio.

He told TechCrunch the fund was somewhat agnostic on startup

sectors, but was leaning toward infrastructure logistics ventures versus consumer finance companies.

On geographic scope, TLcom Capital will

focus primarily on startups in Africa big-three tech hubs — Nigeria,Kenya and South Africa — but is also eyeing rising markets, such as

Ethiopia.

TLcom current Africa portfolio includes Nigerian trucking logistics venture Kobo360, Kenya&sTwiga Foods (a B2B food supply-chain

company) and tech-talent accelerator Andela.

Both of these companies have gone on to expand in Africa and receive subsequent investment by

United States investment bank,Goldman Sachs.

For those startups that wish to pitch to TLcom Capital, Caio encouraged founders to contact

one of the fund partners and share a value proposition

&If it something we find vaguely interesting, we&ll make a decision,& he said.

TLcom Capital closes $71M Africa fund with plans to back 12

startups

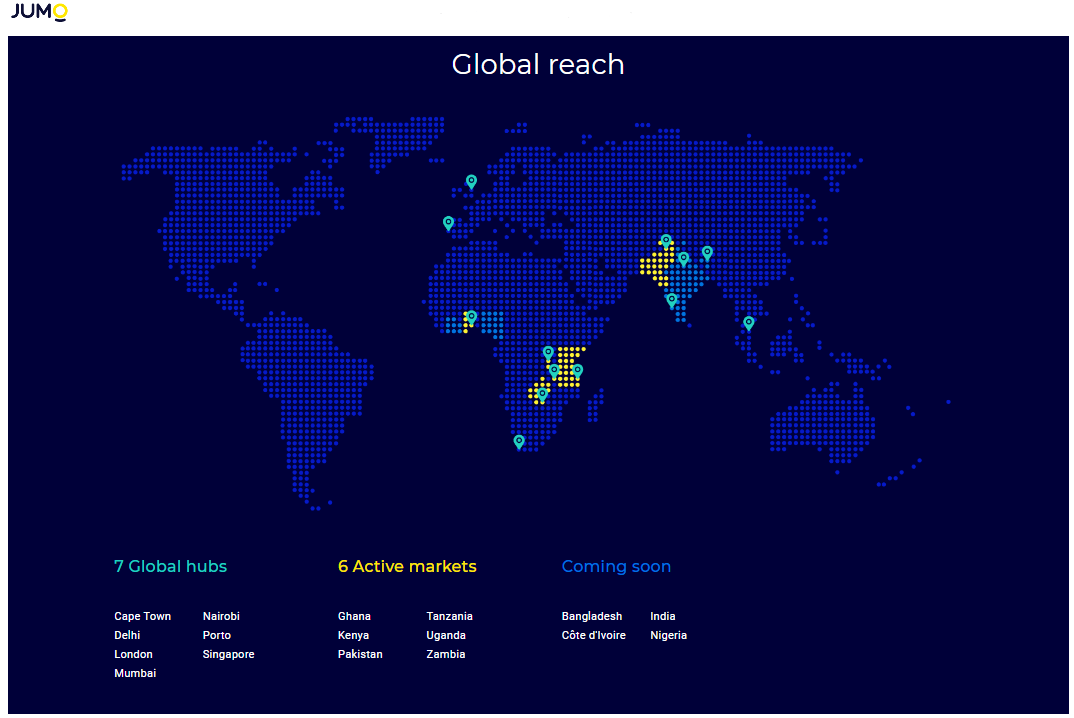

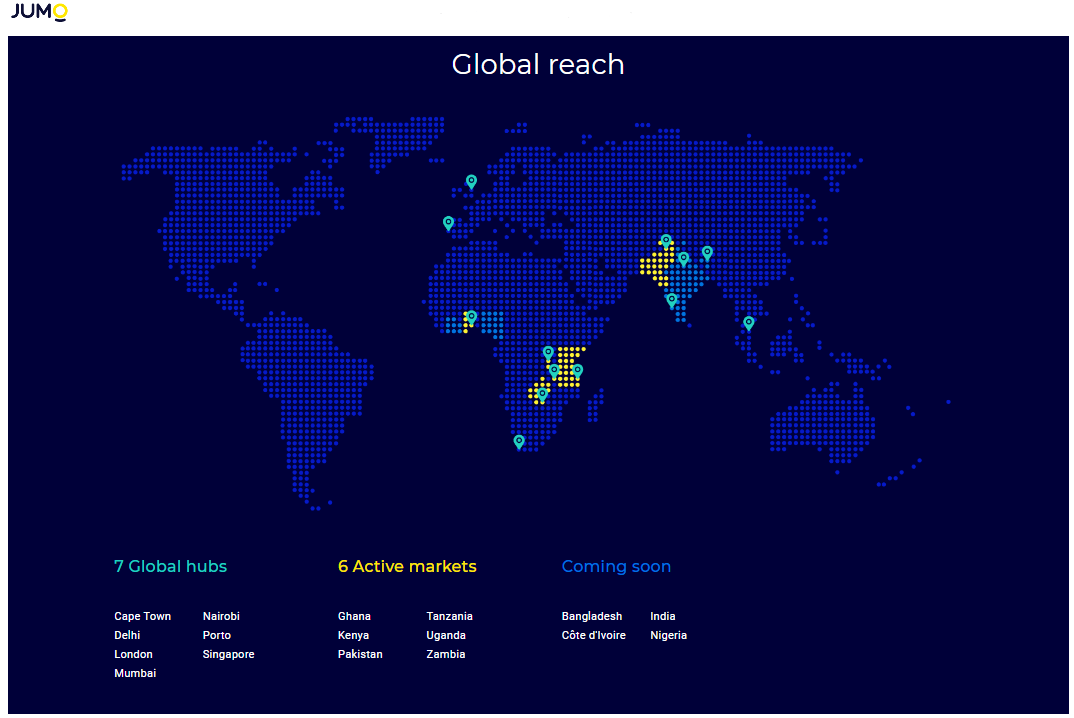

One $50 million round wasn''t enough for South Africa Jumo, so the fintech firm raised another — $55 million — in February,

backed by Goldman Sachs, which led the Cape Town based company $52 million round back in 2018.

This fresh investment comes from new and

existing…investors includingGoldman Sachs,Odey Asset Management and LeapFrog Investments,& Jumo said in a statement — though Goldman

told TechCrunch its participation in this week round isn''t confirmed.

After the latest haul, Jumo has raised $146 million in capital,

according toCrunchbase.

Founded in 2015, the venture offers a full tech stack for partners to build savings, lending and insurance products

for customers in emerging markets.

Jumo is active in six markets and plans to expand to two new countries in Africa (Nigeria and Ivory

Coast) and two in Asia (Bangladesh and India).

The company products have disbursed more than $1 billion in loans and served over 15 million

people and small businesses, according to Jumo data.

Jumo joins a growing list of African digital-finance startups raising big money from

outside investors and expanding abroad

A $200 million investment by Visa in 2019 catapulted Nigerian payments firmInterswitchto unicorn status, the same year the company launched

its Verge card product on Discover global network.

South African fintech startup Jumo raises second $50M+ VC round

Amazon Web Serviceshas

entered a partnership withSafaricom— Kenya largest telco, ISP and mobile payment provider — in a collaboration that could spell

competition between American cloud providers in Africa.

In a statement toTechCrunch,the East African company framed the arrangement as a

&strategic agreement& wherebySafaricomwill sell AWS services (primarily cloud) to its East Africa customer network.

Safaricom — whose

products include thefamedM-Pesamobile money product — will also become the first Advanced Consulting Partner for the AWS partner network

in East Africa.

Partnering with Safaricom plugs AWS into the network of one of East Africa most prominent digital companies.

Safaricom, led

primarily by its M-Pesa mobile money product, holds remarkable dominance in Kenya, Africa sixth largest economy

M-Pesa has 20.5 million customers across a network of 176,000 agents and generates around one-fourth of Safaricom ≈ $2.2 billion annual

revenues (2018).

M-Pesa has 80% of Kenya mobile money agent network, 82% of the country active mobile-money subscribers and transfers 80%

of Kenya mobile-money transactions, per the latest sector statistics.

A number of Safaricom clients (including those it provides payments

and internet services to) are companies, SMEs and startups.

The Safaricom-AWS partnership points to an emerging competition between American

cloud service providers to scale in Africa by leveraging networks of local partners.

The most obvious rival to the AWS-Safaricom strategic

agreement is theMicrosoft-Liquid Telecom collaboration

Since 2017, Microsoft has partnered with the Southern African digital infrastructure company to grow Microsoft AWS competitor product —

Azure — and offer cloud services to the continent startups and established businesses.

More Africa-related stories @TechCrunch

These

specialized Africa VC funds are welcoming co-investors

After VCs spend millions Nigeria restricts ride-hail motorbike taxis

Africa e-tailer

Jumia reports first full-year results post NYSE IPO

Sokowatch raises $14M to digitize Africa informal B2B supply-chain

African crowdsolving

startup Zindi scales 10,000 data scientists

African tech around the ‘net

Ethiopian ed-tech company Gebeya raises $2m funding

round

Nigerian crypto platform Bitfxt lands $15m from UK investors, Payitup parent company