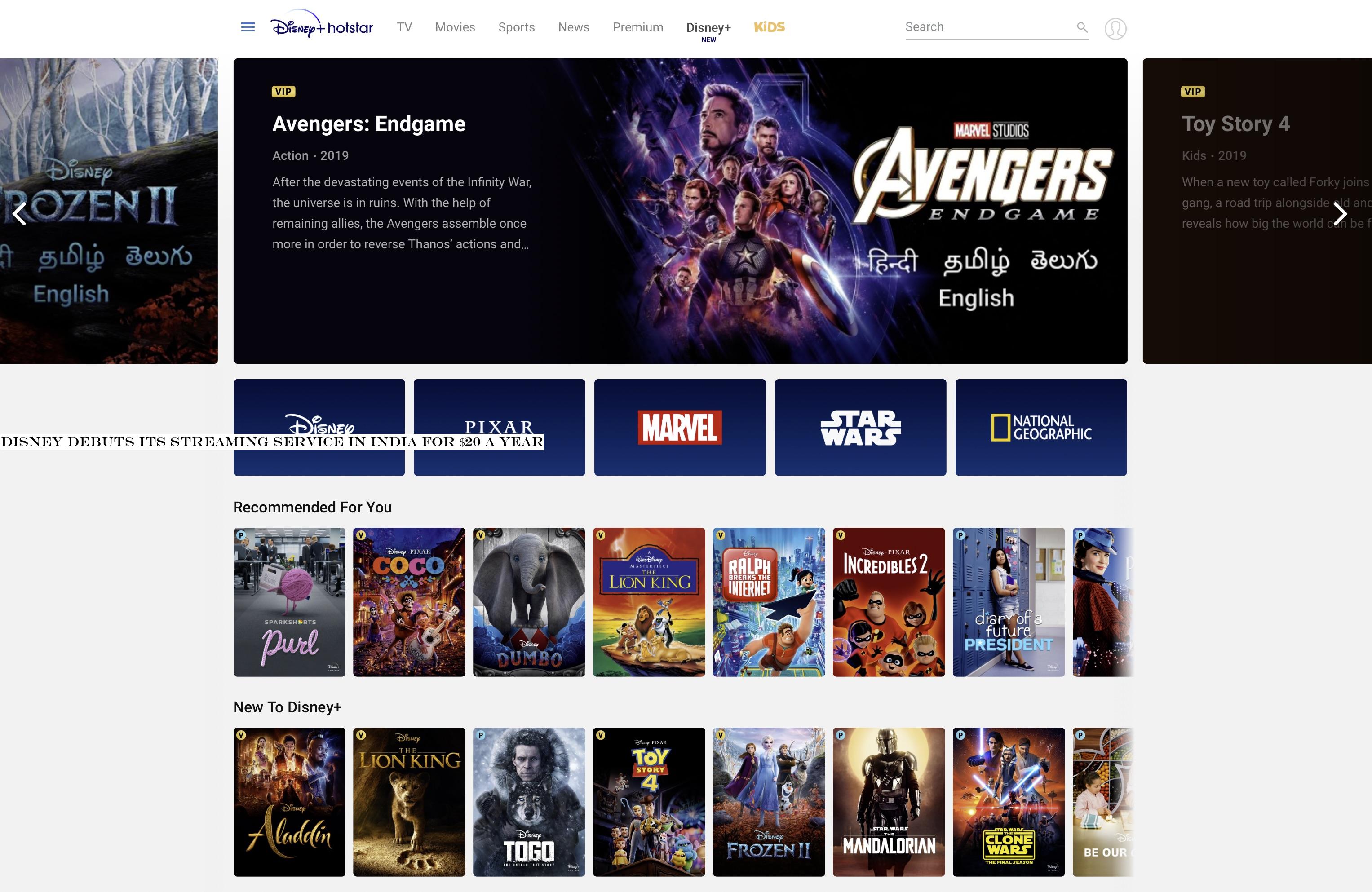

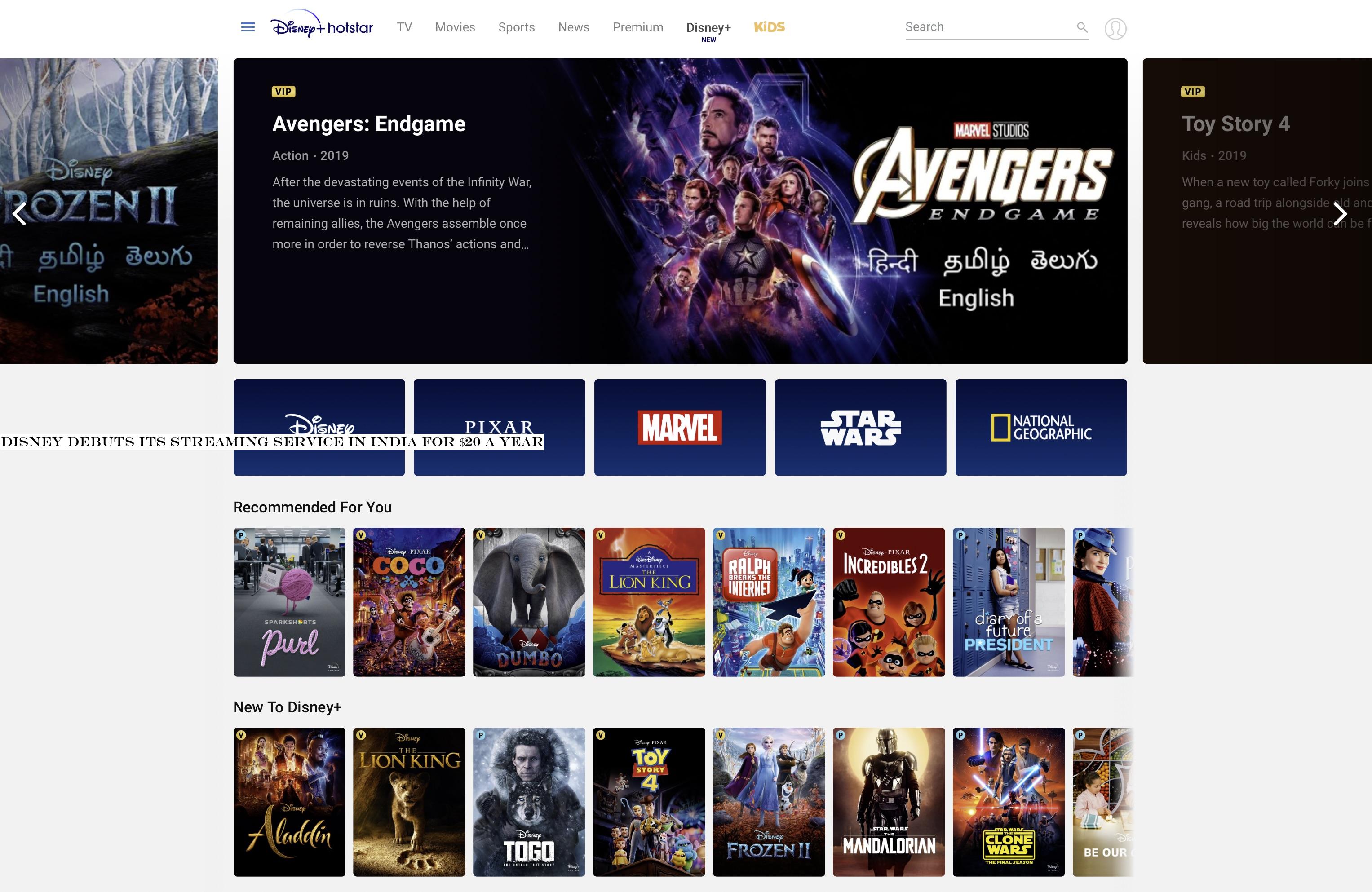

INSUBCONTINENT EXCLUSIVE:

Disney+ has arrived in the land of Bollywood

The company on Friday (local time) rolled out its eponymous streaming service in India through Hotstar, a popular on-demand video streamer

it picked up as part of the Fox deal.

To court users in India, the largest open entertainment market in Asia, Disney is charging users 1,499

Indian rupees (about $19.5) for a year, the most affordable plan in any of the more than a dozen markets where Disney+ is currently

available.

Subscribers of the revamped streaming service, now called Disney+ Hotstar, will get access to Disney Originals in English as well

as several local languages, live sporting events, dozens of TV channels, and thousands of movies and shows, including some sourced from HBO,

Showtime, ABC and Fox that maintain syndication partnerships with the Indian streaming service

It also maintains partnership with Hooq — at least for now.

Unlike Disney+ offering in the United States and other markets, in India, the

service does not support 4K and streams content at nearly a tenth of their bitrate.

Disney+ Hotstar is also offering a cheaper yearly

premium tier, priced at Rs 399 (about $5.3), that will offer subscribers access to movies, shows (but not those sourced from aforementioned

United States networks and studios) and live sporting events; it won''t include Disney Originals.

Access to streaming of sporting events,

especially of cricket matches, has helped five-year-old Hotstar become the most popular on-demand video streaming in India

During the cricket tournament Indian Premier League (IPL) last year, the service amassed more than 300 million monthly active users and more

than 100 million daily active users.

It also holds the global record for most simultaneous views on a live stream, about 25 million — more

than thrice its nearest competitor.

Prior to today launch, Hotstar offered its premium plans at 999 Indian rupees, and 365 Indian rupees

Existing subscribers won''t be affected by the price revision for the duration of their current subscription.

The service, run by Indian

conglomerate Star India, offers access to about 80% of its catalog at no cost to users

The company monetizes these viewers through ads.

But in recent years, the company has begun to explore ways to turn its users into

Two years ago, Hotstar stopped offering cricket match streaming to non-paying users.

People familiar with the matter told TechCrunch that

Hotstar has about 1.5 million paying subscribers, lower than what most industry firms estimate

But that figure is still higher than most of its competitors.

And there are many.

India on-demand video market

Disney+ will compete with

more than three dozen international and local players in India, including Netflix, Amazon Prime Video, Times Internet MX Player (which

has over 175 million monthly active users), Zee5, Apple TV+ and Alt Balaji, which has amassed over 27 million subscribers.

The arrival of

Disney+ in India is another case study in the globalization of entertainment in the digital era

For decades, the biggest companies in the world have expanded their reach into different markets

But it new, and actually quite profound, that everyone on earth receives the very same version of such a specific cultural product,& Matthew

Ball, former head of strategic planning for Amazon Studios, told TechCrunch.

As in some other markets, including the United States ,

streaming services have inked deals with telecom networks, TV vendors, cable TV operators and satellite TV players to extend their reach in

India.

Most of these streaming services monetize their viewers by selling ads, and those who do charge have kept their premium plans below

$3.

Why that figure? That the number most industry executives think — by spending years in the Indian market — that people in the

country are willing to pay for viewing content

The average of how much an individual pays for cable TV, for instance, in India is also about $3.

I think everyone is still trying to sort

It true the average Indian consumer is used to far lower prices and can''t afford more

However, we need to focus on the consumers likely to buy this, who have the requisite broadband access and income, etc,& said

Ball.

Commuters drive along a road past a billboard in Mumbai advertising the Amazon Prime Video online series &The Forgotten Army&

(Photo by INDRANIL MUKHERJEE / AFP via Getty Images)

At stake is India booming on-demand video streaming market that, according to Boston

Consulting Group, is estimated to grow to $5 billion from half a billion two years ago.

Hotstar hold on India could make it easier for

Disney+, which has launched in more than a dozen markets and has amassed over 28 million subscribers.

As the country spends about two more

weeks in lockdown that New Delhi ordered last month to curtail the spread of coronavirus, this could also compel many to give Disney+ a

try.

On the flip side, if the lockdown is extended, the current season of IPL, which has been postponed until mid-April, might be further

delayed or cancelled altogether

Either of those scenarios could hurt the reach of Hotstar, which sees a massive drop in its user base after the conclusion of each cricket

tournament.

Disney initially planned to launch its streaming service in India on March 28, the day IPL was supposed to commence

But the company later postponed the launch by six days.

Industry executives told TechCrunch that if IPL is cancelled, it could severely hurt

the financials of Hotstar, which clocks more than 50% of its revenue during the 50-odd days of the cricket season.

Some said Disney+ premier

catalog might not be relevant for most of Hotstar user base, who seem to care about this streaming service only during the cricket season or

to catch up on Indian soap operas.

Hotstar has also received criticism for censoring more content on its platform than any other streaming

Last month, Hotstar blocked from streaming on its platform an episode of &Last Week Tonight with John Oliver& that was critical of Indian

Prime Minister Narendra Modi

YouTube made that segment available without any edits.

John Oliver slammed Hotstar for censoring the episode and noted that the streaming

service had additionally edited out parts from his older episodes where he made fun of Disney

In 2017, Hotstar also edited out a segment from Oliver show in which he mocked Samsung for the Galaxy Note 7 fiasco

Hotstar and Samsung had a commercial partnership.

Hotstar did not respond to multiple requests for comment in 2017

Hotstar did not respond to multiple requests for comment on the recent controversy.