INSUBCONTINENT EXCLUSIVE:

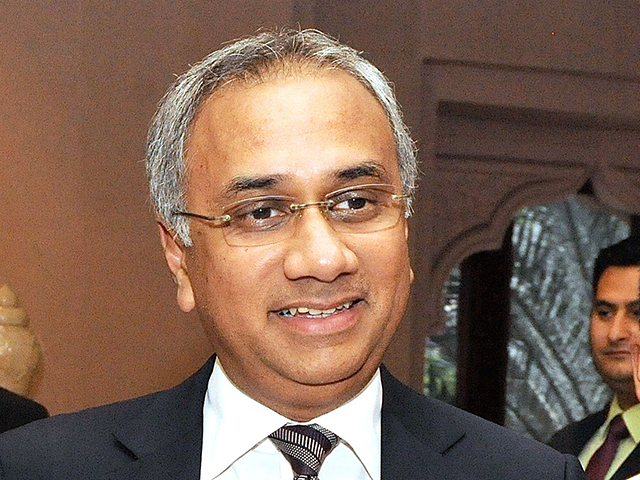

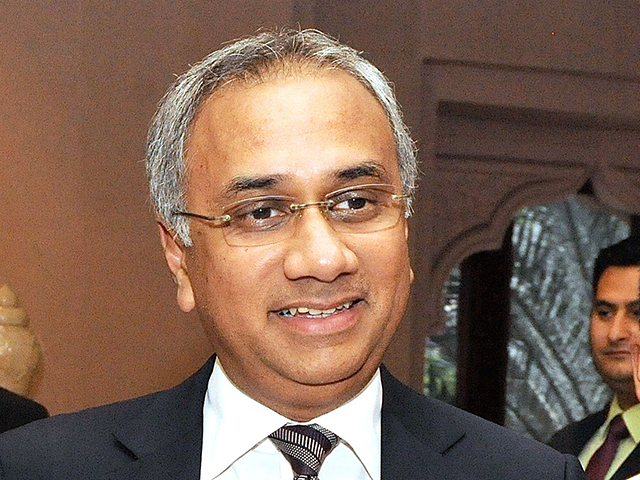

NEW DELHI: The second-largest IT major Infosys is set to unveil its first full quarterly numbers under its new CEO and MD Salil Parekh this

To be sure, it will be more than just quarterly results

It will be about FY19 guidance, updates on key business verticals, deal wins and the long-term road map from Parekh, the second non-promoter

CEO for the IT giant.

It's worth recalling that the management of Infosys had to slash revenue growth guidance for FY18

This time, industry watchers expect a conservative FY19 revenue guidance of 5-8 per cent in constant currency terms from the IT major

The market would also seek information on business outlook amid the ongoing trade tussle and capital allocation plan

What may be in play Let's dive in.

Q4 numbersFor the fourth quarter, analysts expect the IT major to report a growth of 1-2 per cent in

revenue sequentially in constant currency terms and 2-2.5 per cent in dollar revenue quarter on quarter.

"We expect Infosys to post

sequential dollar revenue growth of 2 per cent

This will be the first full quarter for the new CEO and clarity on his strategy will be one of the key monitorables

We expect Infosys to guide to 6.5-8.5 per cent dollar revenue growth for FY19," IDFC Securities said in a note

Infosys' constant currency revenue is expected to grow at 1 per cent QoQ while dollar revenue may rise 1.9 per cent to $2,807.3 million on

cross currency tailwinds, said ICICI Securities

"Rupee revenue may grow 1.5 per cent to Rs 18,065.3 crore

EBIT margins may remain flat QoQ at 24.3 per cent as cross currency benefit gets partially offset by rupee headwind," the brokerage said,

adding that revenue guidance and margin trajectory, outline of strategic priorities and reaffirmation of the capital allocation policy by

the new CEO will be keenly watched.

FY19 guidanceForeign brokerage Citi expects Infosys to guide for 5.5-7.5 per cent revenue growth in

constant currency terms and 6.5-8.5 per cent in dollar terms

Anything lower will disappoint the Street, it said in a note.

Kotak Securities sees Infosys revenue growth guidance at 6-8 per cent on

"Even as the macro environment is positive, translation of the same into pipeline and deals will materialise gradually," it said

Update on BFS verticalThe software firm had offered divergent and positive commentary for its banking and financial services (BFS) vertical

vis-a-vis TCS in the third quarter, according to IT experts.

"We would like to get clarity on the impact of US tax reforms from the

management and whether there is a change in its commentary regarding this vertical," Nirmal Bang Institutional Equities said.

Deal winsThat

apart, large deal wins, if any, will be eyed

Accenture in recent quarters has reported winning mega contracts to the tune of $10 billion as against Infosys, whose deals have been

mediocre for the past several quarters, the Nirmal Bang report stated.

"We will watch out for the large deal TCV (total contract value)

number in Q4 FY18 as we believe it will continue to be an important driver of growth in the next 24-36 months

As legacy services still account for a large portion of its revenue base," it said.

Vision and strategyEdelweiss Securities believes that

Parekh's strategy and vision to drive the company forward will be up in focus

IDFC Securities agrees, which said clarity on the company's strategy will be one of the key monitorables

FY19E revenue guidance and margin trajectory, outline of strategic priorities and reconfirmation of the capital allocation policy will be

the key, said ICICI Securities.