Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

StockMarket

FEATURED FUNDS

Axis Long Term Equity Direct Plan-Growth

- Details

- Category: Stock Market

Read more: Acquire Tata Working as a consultant Solutions, target price Rs 1,970: Chandan Taparia

Write comment (99 Comments)The Great Depression that began with a stock market crash in 1929 and lasted until 1933 scarred a generation with massive unemployment and plummeting economic output.

It reshaped America, shifting migration patterns, and spawning new styles of music, art and literature. Under

- Details

- Category: Stock Market

Read more: A United States recession Probably. Clinical depression Only if the infection is untamed

Write comment (92 Comments)This could well pave the way for the bank’s future fund raising plans as the lender is set to begin a new innings under a new

- Details

- Category: Stock Market

Read more: YES Financial institution raises Rs 3,700 crore via CDs

Write comment (100 Comments)In a joint letter to the Securities - Exchange Board of India

- Details

- Category: Stock Market

Read more: Five custodian banks alert Sebi on FPI permit revival

Write comment (98 Comments)The lack of bids suggests that liquidity has improved in the market for short-term borrowing of government securities as the Fed has pumped in

- Details

- Category: Stock Market

Read more: Fed's term repo operation receives no bids for first time

Write comment (95 Comments)“If the last quarter is anything to go b

- Details

- Category: Stock Market

Read more: No new business, little profit: Banks deal with the capture

Write comment (90 Comments)The decision applies to tough restrictions on how banks assess the risks of everything from mortgages to equities and complex derivatives handled by trading desks on Wall Street and

- Details

- Category: Stock Market

Read more: Banks win additional year for basel funding rule

Write comment (96 Comments)FEATURED FUNDS

Axis Long Term Equity Direct Plan-Growth

- Details

- Category: Stock Market

Read more: IMF says globe already in recession, arising markets require $2.5 trillion

Write comment (99 Comments)The Dow Jones Industrial Average sank 4.1 percent, or 915 points, to 21,636.78.

The broad-based S-P 500 dropped 3.4 percent to 2,541.47, while the tech-rich Nasdaq

- Details

- Category: Stock Market

Read more: US stocks fall, snapping three-day winning streak

Write comment (99 Comments)FEATURED FUNDS

Axis Long Term Equity Direct Plan-Growth

- Details

- Category: Stock Market

Read more: Sell TVS Motor Company, target price Rs 275: Chandan Taparia

Write comment (98 Comments)With the virus spreading rapidly, Prime Minister Narendra Modi announced a three-week nationwide lockdown on Tuesday which will have a

- Details

- Category: Stock Market

Read more: Bruised Indian economic climate to be damaged better by coronavirus: Reuters poll

Write comment (90 Comments)The Reserve Bank of India (RBI) will conduct a variable reverse repo auction where banks can park their excess cash in the system

- Details

- Category: Stock Market

Read more: RBI to draw out Rs 3.5 lakh crore, appropriate price anomalies

Write comment (97 Comments)

FEATURED FUNDS

Axis Long Term Equity Direct Plan-Growth

- Details

- Category: Stock Market

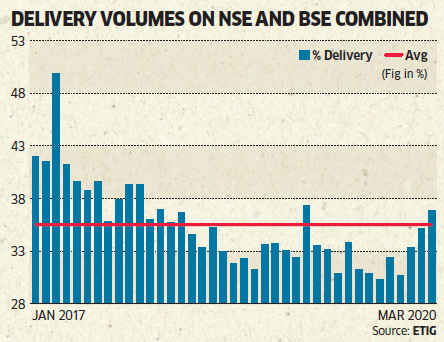

Read more: Spike in delivery-based trades tips at a possible economic crisis

Write comment (90 Comments)Uncertain times leads to panic and also markets have actually reacted accordingly over the past couple of weeks. Nevertheless, it seems panic marketing has actually now come to a halt, at the very least for the time being. The revival of confidence to some extent can be credited to the federal government's efforts the world over to supply stimulus and prevent major damage to economies. After US' $2

- Details

- Category: Stock Market

Read more: Market to supply both sell-on-rally and buy-on-dips possibilities

Write comment (97 Comments)

Right through this week while many brokers and a prominent brokers’ associations that have faced the brunt of the lockdown, have asked for equity and c

- Details

- Category: Stock Market

Read more: How lockdown created absurdities in Indian safety and securities markets

Write comment (96 Comments)The transaction reinforces that investors still bet on sovereign-backed issuances from emerging markets like India.

“It is an extremely important transaction for India especially in t

- Details

- Category: Stock Market

Read more: SBI increases $100 million by means of eco-friendly bonds amidst COVID19 scare

Write comment (90 Comments)FEATURED FUNDS

Axis Long Term Equity Direct Plan-Growth

- Details

- Category: Stock Market

Read more: Brave New World: Where is gold headed Fed annual report telling something

Write comment (95 Comments)The marketplace remained to see technological pullback for the third straight session, as NSE Nifty ended on a strong note on Thursday. After experiencing a quiet beginning to the day, the morning trade saw the index staging a wise rally, which took the benchmark past the 8,700 level. However, it soon came off day s high. For the remaining component of the session,

- Details

- Category: Stock Market

Read more: Profession arrangement: Nifty50 requires fresh buying to expand this rally

Write comment (93 Comments)RBI finally bit the bullet on Friday and responded to the coronavirus-induced crisis with a whopping 75 basis points cut in the

- Details

- Category: Stock Market

Read more: Debt funds get RBI booster; medium, long-term schemes to gain most

Write comment (96 Comments)FEATURED FUNDS

Axis Long Term Equity Direct Plan-Growth

- Details

- Category: Stock Market

Read more: Bernstein cuts Bajaj Financing to 'underperform'

Write comment (97 Comments)The 30-share BSE barometer soared 1,410.99 points or 4.94 per cent to

- Details

- Category: Stock Market

Leading foreign institutional investors such as Capital Group Asset Management, Fidelity

- Details

- Category: Stock Market

Read more: Criterion Life offers 2.5% in HDFC Life for Rs 2,200 crore

Write comment (96 Comments)

FEATURED FUNDS

Aditya Birla Sun Life Tax Relief 96 Direct-Growt..

- Details

- Category: Stock Market

Read more: YES Financial institution to elevate Rs 5,000 crore in fresh round of fundraising

Write comment (99 Comments)We are using line graphes, as they would enable us to take a longer-term framework of the once a week charts. We do this to ensure that we can check out the behavior of the market versus the decade-long pattern line, which stands violated. After a substantial decline of over 12 percent a week before this, Great decelerated its decrease and also ended with a small loss. T.

- Details

- Category: Stock Market

- Details

- Category: Stock Market

Read more: Wall Road week in advance: Fund rebalancing might assist buoy supply rebound

Write comment (100 Comments)

In a late evening release, the bank said it will raise the additional amount through shares, ADRs, GDRs or convertible bonds.

The lender has already raised over Rs 10,000 crore from SBI and other key banks and financial

- Details

- Category: Stock Market

Read more: YES Bank raises fundraising size to Rs 15,000 crore

Write comment (94 Comments)The stocks futures market is not everyone’s cup of tea. Speculators such as position traders, day traders, swing traders and hedgers usually trade in stock futures. Hedgers use futures to hedge price movements of underlying assets. The ultimate goal is to prevent losses from potentially unfavourable price movement rather than to

- Details

- Category: Stock Market

Read more: Who can trade in stock futures and what are the pros and cons

Write comment (99 Comments)Traders booked profits in banking stocks on Friday after the announcement of a series of measures, which also included a cut in reverse repo

- Details

- Category: Stock Market

Read more: Banking stocks zoom, then fall as traders book profit

Write comment (99 Comments)The number of Americans filing claims for unemployment benefits surged to 3.28 million last week as state-wide

- Details

- Category: Stock Market

Read more: Dow Jones rallies as task losses stir talk of even more stimulation

Write comment (95 Comments)Page 16 of 464

9

9