Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

StockMarket

The March futures

- Details

- Category: Stock Market

Read more: Nifty traders create fresh shorts in March futures

Write comment (97 Comments)In a letter to the Department of

- Details

- Category: Stock Market

Read more: Vodafone Idea asks DoT for 15 years to pay AGR dues

Write comment (92 Comments)

- Details

- Category: Stock Market

Read more: Cipla shares end marginally lower after USFDA issues warning letter for Goa facility

Write comment (91 Comments)

FEATURED FUNDS

Axis Long Term Equity Direct Plan-Growth

- Details

- Category: Stock Market

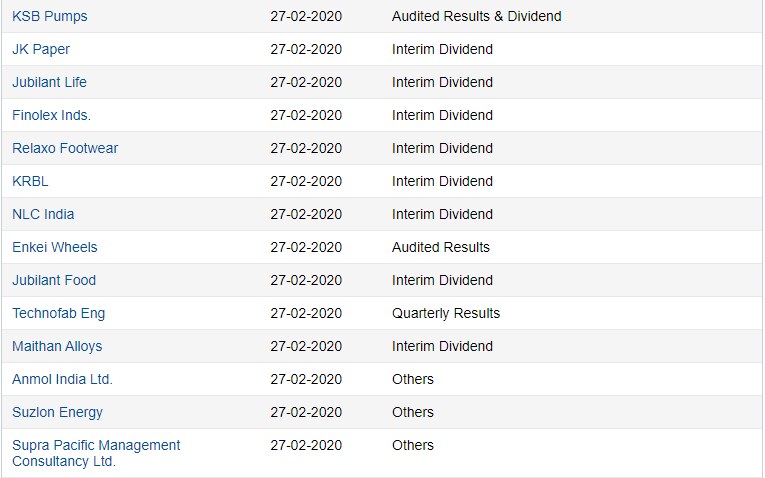

Read more: Board Meetings Today: JK Paper, IOB, Manappuram Finance, Relaxo Footwear

Write comment (90 Comments)

China and the US occupied the first and second spot with 799 and 626 billionaires, respectively.

In total, India got 34 new billionaires to take the count to 138

- Details

- Category: Stock Market

Read more: India added 3 billionaires a month in 2019; Mukesh Ambani richest Indian

Write comment (95 Comments)FEATURED FUNDS

Aditya Birla Sun Life Tax Relief 96 Direct-Growt..

- Details

- Category: Stock Market

Read more: Sebi fines Muthoottu Mini Financiers for misleading advertisements

Write comment (96 Comments)Most new virus cases are now being reported outside China - the origin of the outbreak - with South Korea, Italy and Iran emerging as new epicentres.

Braz

- Details

- Category: Stock Market

Read more: Asian stocks extend losses as pandemic fears grow

Write comment (98 Comments)"The Allotment Committee - NCDs of the company in its meeting held today approved and allotted rated, listed, secured, redeemable, non-convertible debentures (NCD) of face value of Rs 10 lakh each on private placement

- Details

- Category: Stock Market

Read more: Shriram Transport Finance raises Rs 500 crore via bonds

Write comment (91 Comments)Shilpa Medicare closed at 5 per cent lower circuit after getting Form 483 from the US drug

- Details

- Category: Stock Market

- Details

- Category: Stock Market

Read more: Jhunjhunwala co, others in race for IDBI Federal stake

Write comment (100 Comments)

The coronavirus seems to be near the tipping point of becoming a global pandemic. The next few weeks may see infection rates peak for the virus that causes a lung illness dubbed Covid-19 and start to decline, aided by containment efforts and warmer weather in the Northern hemisphere. It seems just as likely that won’t happen, which m

- Details

- Category: Stock Market

Read more: Global markets have 3 coronavirus scenarios to consider

Write comment (96 Comments)

With a close below the 11,700 mark, the index filled the previous gap area between 11,750 and 11,783 levels formed on February 4. Analysts see higher chance of the index moving

- Details

- Category: Stock Market

Read more: Tech View: Nifty50 forms bearish candle; bears to rule below 11,800

Write comment (98 Comments)The Sensex closed below 40,000 for the first time since October, mirroring the panic in rest of Asia and Europe on worries that

- Details

- Category: Stock Market

Read more: Rapid global spread of infection sends FPIs packing from D-Street

Write comment (95 Comments)- Details

- Category: Stock Market

Read more: Trade setup: Nifty50 may stage a short covering-led pullback

Write comment (97 Comments)As a result, the market capitalisation of the

- Details

- Category: Stock Market

Read more: Sensex slumps 1,434 points in 4 days; is it time for bottom fishing

Write comment (99 Comments)- Details

- Category: Stock Market

Read more: Following banks’ lead, cos cut deposit rates by up to 45 bps

Write comment (92 Comments)

Investors were cautious as the U.S. Centers for Disease Control and Prevention urged Americans to prepare for the virus to spread in the United

- Details

- Category: Stock Market

Read more: Wall Street gains ground after virus-driven selloff

Write comment (99 Comments)India’s $2.1 trillion stock market is drawing increasing foreign investment as the country remains relatively unscathed from the coronavirus outbreak threatening lives and economies around the world.

Fund management firms including Eastspring Investments and Northcape Capital are flagging the

- Details

- Category: Stock Market

Read more: As cornavirus spreads, Indian stocks offer shelter to global funds in Asia

Write comment (95 Comments)So far, 204 companies have announced dividends since February 1, compared with 90 during the similar period in 2019 and 98 in 2018. The boards of 32

- Details

- Category: Stock Market

Read more: Great Indian dividend festival’s on before new tax rules kick in

Write comment (98 Comments)

InterGlobe Aviation, parent of the country's largest airline IndiGo, also said it has strong processes for ensuring arm's length dealings

- Details

- Category: Stock Market

Read more: IndiGo says have responded to all Sebi queries on related party transactions

Write comment (94 Comments)Greenwich is a leading provider of proprietary benchmarking data, analytics, and qualitative insights to financial services firms worldwide.

Based at Stamford in Connecticut, it serves over 300 clients across top

- Details

- Category: Stock Market

Read more: Crisil completes acquisition of Greenwich Associates

Write comment (100 Comments)SBI: Morgan Stanley has raised its price target on State Bank of India by 14 per cent to Rs 375 citing better performances of its subsidiaries — m

- Details

- Category: Stock Market

Read more: Stocks in the news: SBI, Bharti Airtel, Vodafone Idea, HUL, Apollo Tyres, IDBI Bank

Write comment (90 Comments)- Details

- Category: Stock Market

Read more: Govt closely monitoring coronavirus impact on economy: FM Sitharaman

Write comment (99 Comments)

Shares of Sunteck Realty (down 2.84 per cent), Indiabulls Real Estate (down 2.13 per cent), Sobha (down 1.89 per cent), Prestige Estates Projects (down 1.85 per cent) and Godrej Properties (down 1.57 per cent) too were among the losers.

Mahindra Lifespace Developers

- Details

- Category: Stock Market

Read more: Stock market update: Realty stocks collapse; Sunteck Realty slides 3%

Write comment (93 Comments)“In all fairness, Deepak and I have no differences,” Aditya Puri tol

- Details

- Category: Stock Market

Read more: Deepak and I on same page on successor: Aditya Puri

Write comment (99 Comments)

The markets regulator pointed out that it had earlier allowed mutual fund distributors and registered investment advisors to use the platform for purchase and

- Details

- Category: Stock Market

Read more: Sebi allows investors to directly transact in mutual fund units on bourses

Write comment (91 Comments)

FEATURED FUNDS

Aditya Birla Sun Life Tax Relief 96 Direct-Growt..

- Details

- Category: Stock Market

Read more: Tata Motors' board approved committee gives nod to raise Rs 500 crore

Write comment (92 Comments)People with knowledge of the

- Details

- Category: Stock Market

Read more: Bharti Infratel awaits SC verdict for Indus decision

Write comment (92 Comments)

The directions came after the

- Details

- Category: Stock Market

Read more: Sebi directs Orion Industries, officials to refund illegally collected amount

Write comment (99 Comments)The company has

- Details

- Category: Stock Market

Read more: InterGlobe Aviation shares fall nearly 2%

Write comment (90 Comments)Page 33 of 463

5

5