After falling close to 30 per cent on bourses in the December 2019 quarter, InterGlobe Aviation is back on investors radar.

The stock of the company, which operates IndiGo, Indias largest airline by market share, has gained close to 10 per cent in the year-to-date period.One of the key triggers for the renewed interest is the possibility of the resolution of the restriction on sale of promoter stake during the companys upcoming extraordinary general meeting slated for January 29.

The two promoters, Rahul Bhatia and Rakesh Gangwal, each own close to 37 per cent stake.

According to analysts, the removal of such restrictions will open the doors for strategic investment in the company.This would generate incremental funds, which would come in handy in achieving the airlines aggressive capacity addition strategy.

Given its market share of close to 47.5 per cent and relatively better balance sheet than Indian peers, any favourable change regarding the promoter stake sale would act as a sentiment booster.Besides, the aviation regulators extension of the deadline to change the faulty Neo engines on Boeing aircraft to May 31 from January 31 has convinced analysts to revise their capacity addition guidance for FY20.

Before the extension of the deadline, analysts had cut it to 14-15 per cent from 22-23 per cent for FY20.Now, with the extension of the deadline, analysts have restored their previous estimates.

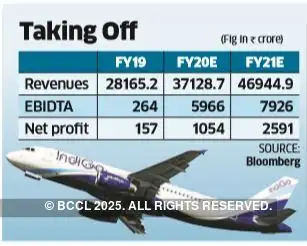

Analysts expect the companys revenue to grow by 4-5 per cent for FY20.A favourable trading range for crude oil prices is another positive factor.

The fall in active Brent crude futures contract by 6.3 per cent to $64 a barrel may boost the airlines revenue for FY20.

Fuel expenses accounted for 40 per cent of the airlines revenue in FY19.

Rajesh Palviya, technical head at Axis Securities said that IndiGos stock may test 1,540-1,550 in the short term.

That is a technically important level since the stock has broken out of the four week range of 1,277-1,415 since January 10.The percentage of delivery against the number of shares traded has risen to a daily average of 25.1 per cent over 14 trading sessions to January 22 against the four-month average of 21 per cent.

Also, traders on the derivatives counter have raised their outstanding positions to 39.56 lakh shares from 33.74 lakh shares on the front month futures contract during this period.

This reflects a bullish build-up.At Thursdays closing price of 1,462, the companys enterprise value (EV) was 7.3 times FY21 operating profit before depreciation (EBITDA) compared with the twoyear average of 14.2.

8

8