By Marton Eder and Zoltan SimonWrite off inflation at your peril.Even in a world where more than a decade of ultra-low interest rates has largely failed to ignite prices, theres still room for a surprise -- as one Hungarian central banker has found.Deputy Governor Marton Nagy told a conference in Budapest in October that inflation was effectively dead globally and near-zero borrowing costs were here to stay.

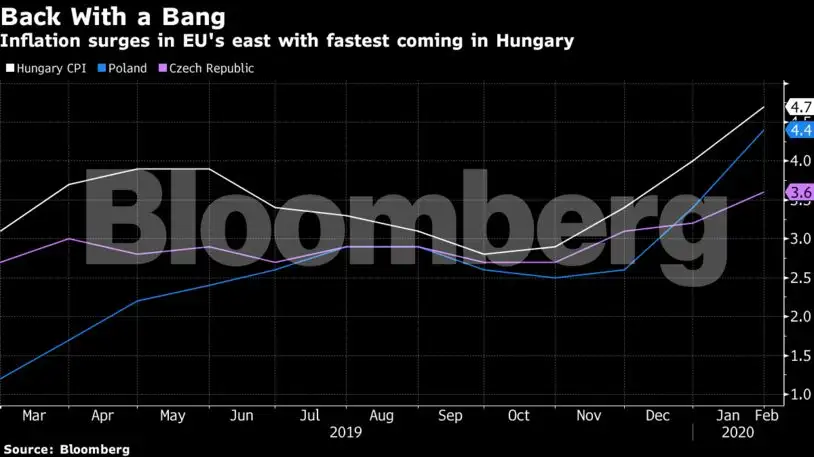

Snap forward just four months and hes facing the fastest ramp-up in prices in the European Union.BloombergHis central bank, one of the planets most dovish, has begun to act -- steering interbank interest rates higher to tame inflation.

Price growth is elevated across Europes east and has already prompted hikes in benchmark borrowing costs elsewhere.Investors are now weighing whether Hungarys policy pivot will amount to more than the fleeting bouts of support theyve witnessed in the past for the forint, which is near a record-low against the euro.The key determination for currency traders is whether this is a more material shift in direction, Goldman Sachs said in an emailed note.

Without a clearer path toward higher rates, the forint will move back to its weakening trend.Inflation rocketed to an annual 4.7% in January, the most in seven years and way above the official 3% target.

The jump left Hungary with one of the lowest real interest rates globally.All ToolsCurrency investors have more attractive options close at hand: the nearby Czech Republic delivered the worlds first rate hike of 2020 this month, its ninth since 2017.Hungary has pledged to use all available tools to contain inflation and is draining liquidity pumped into the system in recent years to keep borrowing costs close to zero.

Thats tightened monetary conditions by the equivalent of two quarter-point rate hikes in the past month.The central bank has room to do more without touching its official benchmark, which at 0.9% is still 30 basis points above interbank rates.BloombergMajor monetary-policy decisions are usually only taken once a quarter, the next possible time coming in March.

But the bank holds monthly meetings, with another set for Tuesday, when its statement will be scrutinized for evidence of a shift in policy.Nagy isnt alone in misreading inflation: Polands central bank is also grappling with an upswing in prices that it didnt predict.And Nagy, who despite being just 43 has worked at the central bank for 18 years, has been right in the past to the extent that his colleagues invariably voted with him on big decisions.In slashing interest rates, he correctly predicted inflation would also ease.

In harnessing the central banks firepower, he helped transform the recession-stricken economy into one of the EUs fastest growing.His recent remarks could yet serve as a warning for others.The lesson from central and eastern Europe is that inflation across the Western world is likely hibernating rather than dead, said Emiel Van den Heiligenberg, head of asset allocation at Legal - General Investment Management in London.

13

13