Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

The Japanese modern technology conglomerate SoftBank Group claimed it would certainly lose a shocking $24 billion on investments made with its Vision Fund as well as bank on the co-working realty firm WeWork and satellite telecommunications firm OneWeb. Inevitably, the business anticipates the losses to assist create a $7 billion overall loss for the innovation giant for the year as its ambitious bank on early-stage companies come up short. Over the previous 2 years SoftBank as well as its creator Masayoshi Child have actually bet billions of (other individuals&& s )bucks and its own fortunes on a vision that financial investments in artificial intelligence modern technologies, robotics and also next-generation telecoms would certainly enjoy thousands of billions in economic benefits. While that was the vision that Boy and his team marketed, the fact was numerous billions of dollars invested right into genuine estate financial investment plays like WeWork, OpenDoor as well as Compass, as well as firms with direct-to-consumer merchandising plays like Brandless, pet dog supply companies like Wag and also the food delivery organisation DoorDash. Add the hotel chain Oyo to the mix and also the financial investment selection from the Vision Fund looks also less visionary. Over the previous year, numerous of its investments ran marooned. Though none imploded as spectacularly as WeWork —-- whose appraisal was slashed from greater than $40 billion to around $8 billion —-- numerous have actually battled. Brandless failed previously this year, and also realty financial investments in Compass together with investments in traveling and tourism-related services like Oyo have actually endured in the wake of the COVID-19 break out, which has actually shuttered economic climates around the globe. While numerous SoftBank and also SoftBank Vision Fund bets were made into firms that have actually fallen short, seem to be on that course or maybe might battle in the financial slump, not every wager is a jalopy. The Vision Fund placed great deals of capital right into Slack before it went public, and the company has actually captured a significant tailwind in the remote-work boom that we&& re presently seeing in light of COVID-19. Possibly one of the most visionary of the SoftBank financial investments (as well as one not included in the Vision Fund), OneWeb, too, collapsed under the weight of its very own capital-intensive vision for a network of satellites supplying high-speed global telecommunications solutions. Zume, SoftBank&& s robot pizza delivery service, likewise folded up. The only factor all of these wagers haven&& t entirely destroyed SoftBank is that the firm still has a golden goose in its Alibaba stake and a reasonably solid core organisation in telecoms and semiconductor holdings. && The distinction in revenue prior to earnings tax is, in enhancement to the above, primarily as a result of the anticipated recording of non-operating loss totaling about JPY 800 billion for financial 2019 on investments held outside of SoftBank Vision Fund, including The We Business (WeWork) and also WorldVu Satellites Limited (OneWeb),& & the firm stated in a statement. & This will certainly be partly balanced out by the gain relating to the negotiation of variable prepaid forward agreement making use of Alibaba shares recorded in the initial quarter of monetary 2019 and also the dilution gain from changes in equity passion in Alibaba recorded in the third quarter of fiscal 2019, in addition to an expected year-on-year boost in revenue on equity approach financial investments pertaining to Alibaba.&& Eventually, it seems that Kid was as well enamored of the folklore he&& d produced around himself as a maverick as well as a visionary. To the hinderance of his business & s outside shareholders as well as financiers . As Bloomberg kept in mind in an op-ed earlier today: Boy&& s insistence that startups grow faster than their founders intended, and strong-arm them right into taking more money than they could have desired, has actually become a problem. Which&& s come to be a huge responsibility to financiers in the Vision Fund and also SoftBank, as well. By throwing money around, loads of startups came to be addicted to spending rather of developing fiscal discipline right into their company versions. For years, it appeared like an audio approach. By having even more money than competitors, SoftBank-backed business might win market share by using bigger incentives, taking out much more ads and luring the very best skill. Today, SoftBank has a major stake in market leaders like Uber Technologies Inc., WeWork, Grab Holdings Inc. and also Oyo. But reaching primary doesn&& t mean paying. The Japanese technology corporation SoftBank Team said it would certainly lose an incredible $24 billion on investments made via its Vision Fund as well as bets on the co-working property business WeWork as well as satellite telecoms company OneWeb. Inevitably, the business anticipates the losses to help generate a $7 billion failure for the modern technology giant for the year as its enthusiastic bank on early-stage firms lose. Over the previous 2 years SoftBank as well as its creator Masayoshi Kid have staked billions of (other individuals&& s )dollars and also its very own fortunes on a vision that financial investments in device discovering technologies, robotics and also next-generation telecoms would reap numerous billions in economic incentives. While that was the vision that Boy and also his team sold, the truth was multiple billions of dollars spent into real estate investment plays like WeWork, OpenDoor and Compass, and also companies with direct-to-consumer merchandising plays like Brandless, pet dog supply services like Wag as well as the food delivery service DoorDash. Add the hotel chain Oyo to the mix and also the investment choice from the Vision Fund looks also less visionary. Over the past year, numerous of its investments ran grounded. Though none of them imploded as marvelously as WeWork —-- whose assessment was slashed from greater than $40 billion to around $8 billion —-- lots of have battled. Brandless went breast earlier this year, and property financial investments in Compass together with investments in traveling and tourism-related services like Oyo have experienced following the COVID-19 outbreak, which has actually shuttered economies worldwide. While many SoftBank and also SoftBank Vision Fund bets were made right into firms that have fallen short, appear to be on that particular course or probably may have a hard time in the economic downturn, not every wager is a clunker. The Vision Fund put great deals of resources into Slack before it went public, and also the firm has caught a massive tailwind in the remote-work boom that we&& re presently seeing because of COVID-19. Possibly the most visionary of the SoftBank financial investments (and one not included in the Vision Fund), OneWeb, as well, collapsed under the weight of its very own capital-intensive vision for a network of satellites providing high-speed international telecoms solutions. Zume, SoftBank&& s robotic pizza distribution business, additionally folded up. The only factor all of these wagers haven&& t entirely ruined SoftBank is that the company still has a moneymaker in its Alibaba stake and a fairly strong core organisation in telecommunications and semiconductor holdings. && The difference in earnings prior to revenue tax obligation is, along with the above, primarily because of the expected recording of non-operating loss completing roughly JPY 800 billion for financial 2019 on financial investments held outside of SoftBank Vision Fund, consisting of The We Company (WeWork) as well as WorldVu Satellites Limited (OneWeb),& & the company claimed in a statement. && This will certainly be partially offset by the gain connecting to the negotiation of variable pre-paid onward agreement utilizing Alibaba shares taped in the initial quarter of financial 2019 and also the dilution gain from changes in equity rate of interest in Alibaba videotaped in the 3rd quarter of financial 2019, in addition to an anticipated year-on-year rise in revenue on equity technique investments related to Alibaba.&& Ultimately, it appears that Child was also enamored of the mythology he&& d created around himself as a maverick and also a dreamer. To the detriment of his firm&& s outside investors and also financiers. As Bloomberg noted in an op-ed earlier today: Son&& s persistence that startups expand faster than their owners prepared, as well as strong-arm them into taking even more money than they could have desired, has actually transformed into a burden. Which&& s become a substantial liability to investors in the Vision Fund as well as SoftBank, too. By throwing money around, lots of start-ups came to be addicted to investing instead of building fiscal discipline right into their service models. For many years, it looked like a sound method. By having even more money than rivals, SoftBank-backed business could win market share by offering bigger incentives, obtaining extra advertisements as well as tempting the finest ability. Today, SoftBank has a significant stake in sector leaders like Uber Technologies Inc., WeWork, Grab Holdings Inc. as well as Oyo. But climbing up to number one doesn&& t mean paying.

- Details

- Category: Technology Today

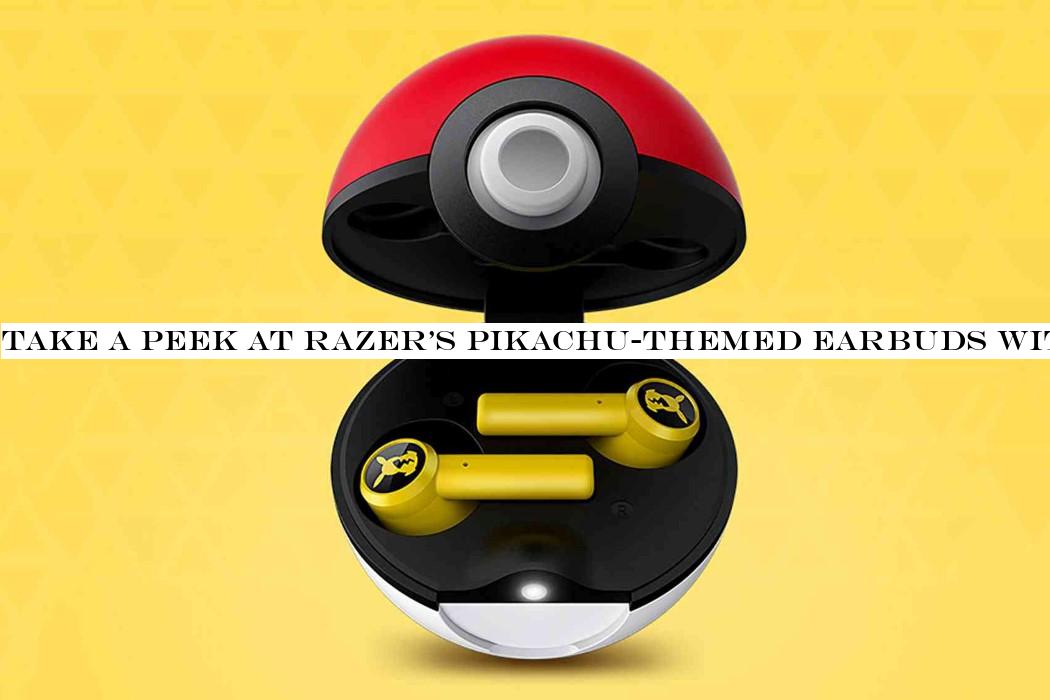

If your love of Pokémon is stronger than your love of battery life, you may find these Pikachu-themed wireless earbuds from Razer to be of interest, as discovered by Zing Gadget from a post on Razer's Weibo account.

On sale in China from April 16 for ¥999 (around $141 / £112 / AU$220), the earbuds are a Pikachu-yellow variation of Razer's existing H

- Details

- Category: Technology Today

Read more: Take a peek at Razer's Pikachu-themed earbuds with Pokéball billing case

Write comment (98 Comments)

Around this time of year, we’re usually eager to see the big, flashy flagship phones that were introduced at MWC finally reach the public. But this is no ordinary year, and the outbreak of Covid-19 hasn’t just cancelled MWC 2020 and messed with phone releases – it’s disrupted lives all over the world.

Which makes the iPhone 9 and OnePlus 8 far more

- Details

- Category: Technology Today

Read more: Why iPhone 9 and also OnePlus 8 are needed now greater than foldable phones

Write comment (98 Comments)

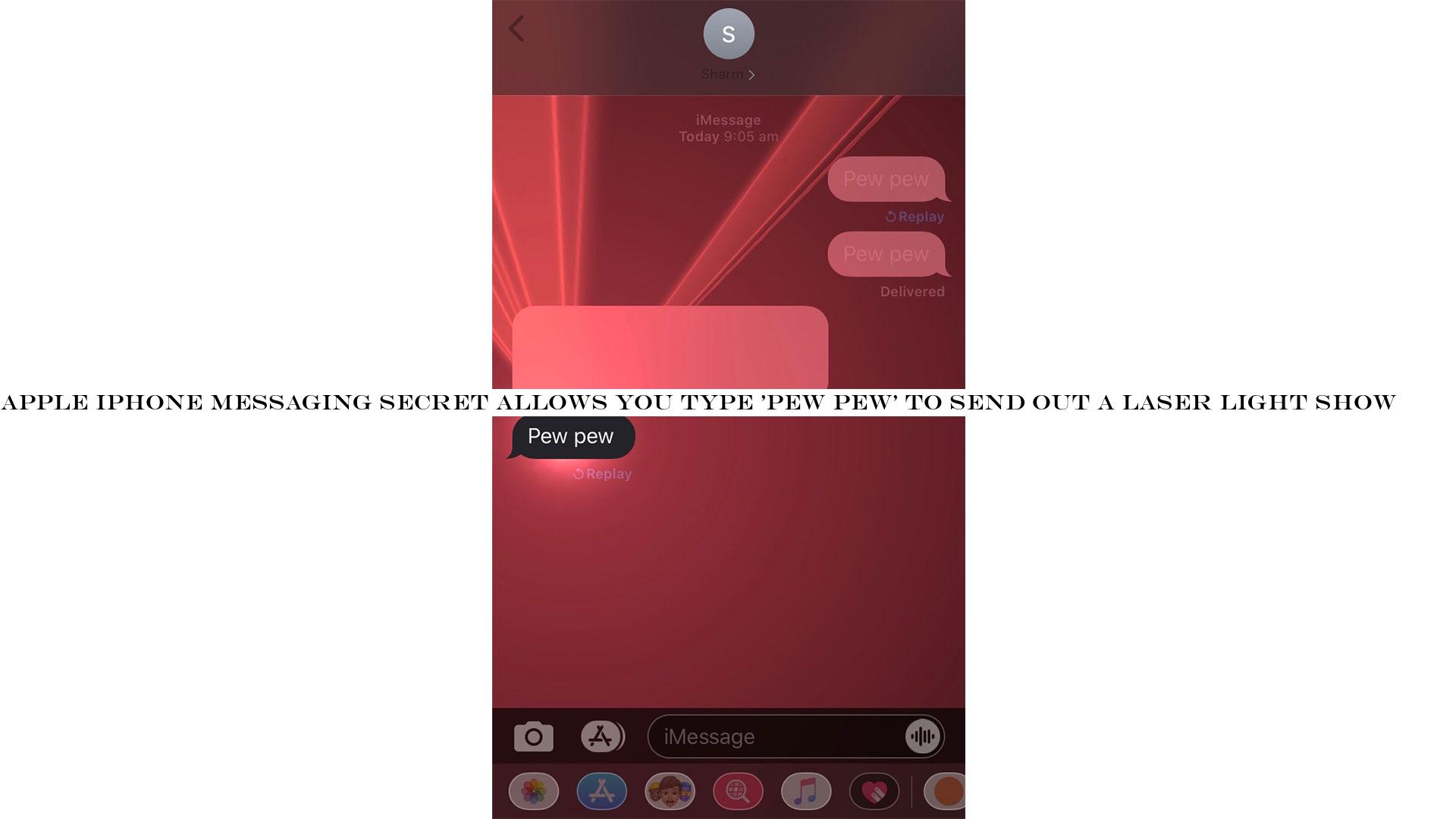

If you’ve exhausted your streaming services, cleaned the house two times over and need something new to occupy your time, iPhone users can type “pew pew” to their iOS friends and amuse them with lasers – or just as easily annoy them.

In a sure sign that cabin fever is getting to us, it’s recently come to the internet’s attention that typing “pew pew

- Details

- Category: Technology Today

Read more: apple iphone messaging secret allows you type 'pew pew' to send out a laser light show

Write comment (90 Comments)

One of the best rugged smartphones we've seen, the Blackview BV9800 Pro, now has a successor - the unimaginatively titled BV9900 Pro.

Although it costs just a little more than the handset it replaces and is more of an iterative upgrade than a wholesale transformation, that doesn't mean it's not special.

Blackview BV9900 Pro - $456.49 at AliExpressIt

- Details

- Category: Technology Today

Read more: 'Killer' simply improved: the cheapest heat-seeking rugged mobile phone has an upgrade

Write comment (95 Comments)

Reliance JioFiber rolled out an affordable Rs 199 plan (additional GST) at the end of December 2019 as a stand-alone offering. Today, the ISP is now also making the same plan available to users as an add-on over their current plans.

After the 1TB limit is reached, the speed drops to 1Mbps. Since this plan can act as a stand-alone and as an add-on,

- Details

- Category: Technology Today

Read more: JioFiber Rs 199 plan currently readily available as an add-on to existing plans

Write comment (90 Comments)Page 971 of 1421

9

9