Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

We had a great time hosting noted immigration attorney Sophie Alcorn on a live conference call with Extra Crunch members earlier this week.

Sophie writes our &Dear Sophie& column, where she answers questions about immigration status, particularly for founders and others in the tech ecosystem who want to work in the United States.

In our conference call, we talked about the changes happening to H-1B visas, what COVID-19 is doing to the immigration system and some of the top concerns of founders in these perilous times. Below the jump, you&ll find an edited transcript, or you can listen to the call in its entirety.

As with all legal advice, always speak with your own retained attorney about specific details regarding your own cases as illustrative examples may or may not apply to your own unique situation.

- Details

- Category: Technology Today

Read more: Attorney Sophie Alcorn answers readers’ immigration questions

Write comment (90 Comments)No one wants to prepare for their fundraising round to fail. Many founders spend months (or even years) getting their businesses to a point where they&re ready to pitch investors. But there are times when, no matter how hard you try, you&re just not going to be able to close a deal.

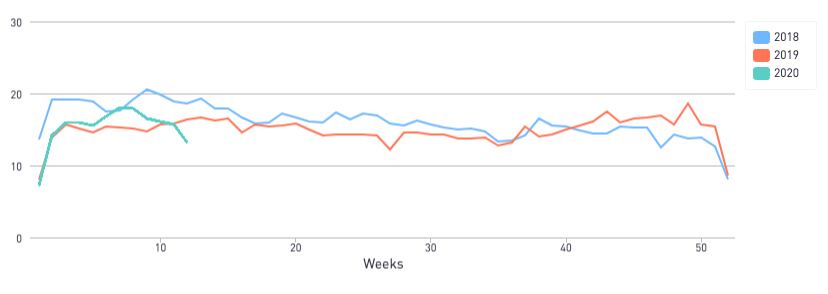

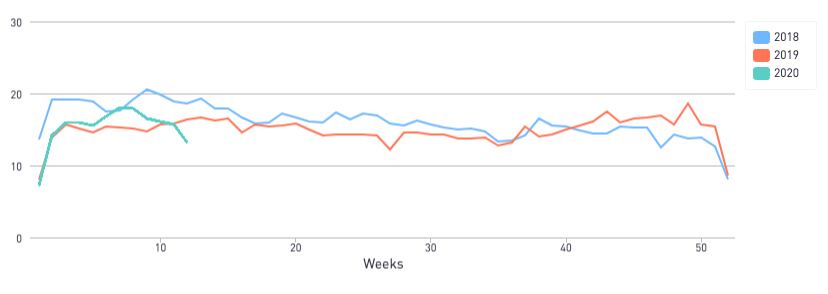

With the current COVID-19 pandemic, the entire VC community is in a state of uncertainty, and there is no clear answer when it comes to the question, &can I still raise funds for my company?& However, therehope for early-stage startups. We used the 2020 DocSend Startup Index to track Pitch Deck Interest among investors and found that last week, despite seismic changes across the country, pitch deck interest has only been 11.6% lower than the same week in 2019 so far.

We will be monitoring the Pitch Deck Interest Metric in the coming weeks, but if you&re an early-stage startup and you were planning to raise, there is still opportunity to come away with a term sheet. But if things don&t go as planned, how do you know if ittime to give up or if you just need to push through?

According to recent DocSend data, you&ll know pretty quickly if ittime to call it quits. While the average founder who was successful in fundraising contacted 63 investors during their process, startups that weren&t able to raise funds stopped at 27. Why stop? Because the founder listened to the feedback they were getting. If you hear the same concern or piece of feedback twice you should take it to heart, but if you hear it three times you probably need to stop and rethink things.

The Pitch Deck Interest Metric declined 11.6% compared to the same week in 2019

According to our study on the fundraising process of pre-seed startups, founders who were unsuccessful in raising had just nine meetings. That should give you enough feedback to know if you have a deal breaker in your deck.

But negative feedback doesn&t mean all is lost. In fact, of startups studied in the 2020 DocSend Startup Index, 86% reported that they were going to try to fundraise again after addressing the feedback they&d received.

- Details

- Category: Technology Today

Read more: When is it time to stop fundraising

Write comment (94 Comments)On Thursday, the FDA amended their emergency policy around diagnostic testing for SARS-CoV-2, the novel coronavirus that causes COVID-19. Following on a change made March 16, the agency opened the door for a number of specific private entities and labs to develop and distribute tests that can provide results on the spot in as little as 15 minutes — but there are some pretty big caveats to keep in mind as you hear about more of these coming to market.

The tests, which are &serological,& meaning they identify the presence of antibodies in a personblood, differ considerably from the molecular testing that is currently in use under Emergency Use Authorization (EUA) by FDA-approved labs and drive-through testing sites. The serological tests show that a person has developed antibodies to SARS-CoV-2, which means they very likely came into contact with it (and either have it, or have already recovered from having it). The molecular tests actually detect the presence of viral DNA in the blood stream, which is a much more definitive indicator that they currently have an active infection (at least at the time the swab was taken).

Serological tests have still been used widely in countries where the response to the COVID-19 pandemic has been shown to be effective, including in China, Taiwan and Singapore. They&ve also been used in different communities in the U.S., based on earlier guidelines around private lab diagnostics. But on March 26, the FDA named 29 entities that provided notification to the agency as required and are now therefore able to distribute their tests.

Itimportant to note that these tests have not been reviewed or validated by the FDA, unlike those molecular tests that are included in the organizationemergency use category. Instead, the FDA &does not intend to object to the development and distribution by commercial manufacturers& of these tests, provided they meet a number of criteria, including qualifying the results of their reported test results with the following information:

- This test has not been reviewed by the FDA.

- Negative results do not rule out SARS-CoV-2 infection, particularly in those who have been in contact with the virus. Follow-up testing with a moleculardiagnostic should be considered to rule out infection in these individuals.

- Results from antibody testing should not be used as the sole basis to diagnose or exclude SARS-CoV-2 infection or to inform infection status.

- Positive results may be due to past or present infection with non-SARS-CoV-2 coronavirus strains, such as coronavirus HKU1, NL63, OC43, or 229E.

The FDA specifically notes in its emergency use FAQ that these entities have reported their own validation of these tests, and that they won&t be pursuing Emergency Use Authorization. That said, therenow nothing stopping the entities on this list from distributing their tests, which means they will be able to be put to use in testing Americans and painting a larger picture of the potential spread of the novel coronavirus — with the caveat noted above that the FDA doesn&t consider these tests used alone to be positive confirmation of a definite SARS-CoV-2 case, or conversely, a sure indicator that someone doesn&t have the virus.

Still, in the absence of better options like expanded availability of the tests that are approved under the EUA, these serological tests (many of which can provide on-site results with just a pinprick of blood) will be useful in painting a more accurate picture of the overall spread and reach of the coronavirus, especially for smaller clinics, GP clinics and local labs that don&t have priority access to the equipment and supplies needed for the molecular testing efforts.

For instance, one test on this list, the Healgen Scientific COVID-19 IgG/IgM (Whole Blood/Serum/Plasma) Rapid Test Device, requires no instrumentation and can provide results in just 15 minutes. Distributor Ideal Rehab Care is working with its legal representation Fox Rothschild to begin importing the tests from Singapore for use &as soon as possible.&

The FDA updating its website with Healgen as one of the entities that have notified it of intent to use its serological test is what unlocked the ability for the company to begin distribution: Itstill illegal for anyone not on this list to do so, and the FDA still also specifically prohibits the use of at-home serological tests on its official guidelines.

- Details

- Category: Technology Today

Many founders will have kicked off the new year with a new fundraising round. According to the data we shared last year, March, October and November were the months when VCs were reviewing the most decks.

But the COVID-19 pandemic has ground to a halt many industries, and there are even warnings that this will affect the next two quarters in regards to fundraising.

We&ve reviewed the data in our 2020 DocSend Startup Index and we&ve begun tracking the Pitch Deck Interest Metric. With San Francisco under a shelter-in-place order and many VCs scrambling to adjust their processes to an all-remote world, we saw pitch deck interest drop 11.6% when compared to the same week in 2019. While there has been a drop in interest so far, there is still a lot of activity, and VCs seem to still be reading pitch decks.

We will be monitoring the Pitch Deck Interest Metric in the coming weeks, but if you&re an early-stage startup and are in the middle of your fundraise, or are about to fundraise, there are some things you can do to help insure your startup is ready for funding before you meet with any (more) investors.

The Pitch Deck Interest Metric declined 11.6% compared to the same week in 2019

Expectations have shifted and will continue to do so

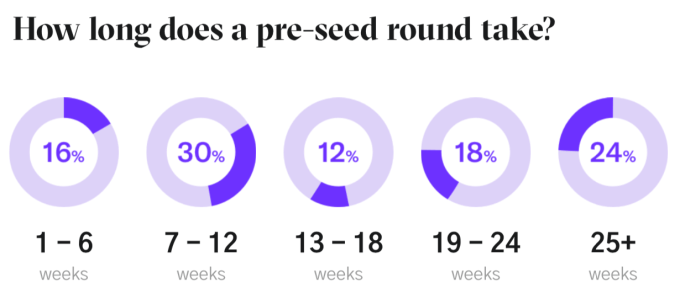

If you were about to kick off a fundraising round, you should have been prepared to contact 50 or more investors, have 20-30 meetings and spend somewhere around 20 weeks before you signed your term sheet. Thata lot of time and energy to invest, especially when the economy is poised for a downturn and you&re most likely needed in other parts of your business.

If you&ve already started your round and are wondering if you should push through, I&ve written a piece on knowing when to quit and recalibrate versus when to push through (Extra Crunch membership required).

Many factors play into navigating a successful fundraising round, and the expectations of investors are constantly changing — specifically when it comes to the pre-seed round.

Investors are now looking for market-ready products and want to see pitch decks that feature the content they&re expecting. We expect to see this focus intensify over the coming months as VCs have more time to spend not just to review pitch decks, but on due diligence for companies in which they plan to invest. Our new report outlines advice for pre-seed startups that are looking to adjust their fundraising strategy.

Focus on an MVP, not just a great PowerPoint

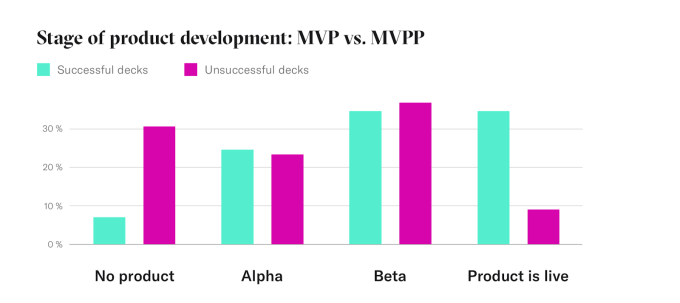

Our analysis reveals a shift in the level of readiness required by institutional investment to receive pre-seed funding. In the past, pre-seed startups could get by with just an MVPP (Minimum Viable PowerPoint). But now, investors are placing their bets on pre-seed startups that have already entered the market and developed an alpha, beta or shipping product.

In fact, 92% of companies with successful pitch decks had either an alpha, beta or shipping product, where only 68% of companies with unsuccessful pitch decks presented the same type of product readiness.

As the economy moves closer to a downturn we can expect VCs to be more cautious with their investments. The current data already shows a preference for companies that have live products; itworth the time and effort to be product-ready coming into a pre-seed round or if you&re a startup ready to tackle the round again with a fresh perspective.

Rethink your deck

That said, even if you do have an MVP, rethinking your pitch deck may be something else to consider. Herea good test. Using your pitch deck, spend three to four minutes (thatall the time you&ll get from a VC) to pitch your business to a friend or family member who knows nothing about your business. Afterward, ask them for a one-sentence description of your company. If they&re not clearly describing what your company does and the problem ittrying to solve, you probably need to rethink your pitch deck.

According to our recent report, a &less is more& attitude toward creating a compelling pitch deck for meetings could mean more success in pre-seed fundraising.

Your pitch deck will be your main calling card right now. As community events are being replaced with online gatherings during the COVID-19 pandemic, we can expect to see less one-to-one engagement at these events. So pitching a VC in person is not likely to happen anytime soon. Whether you&re sending them a cold email, or getting a warm intro from a portfolio company, you&re going to need to lead with your pitch deck.

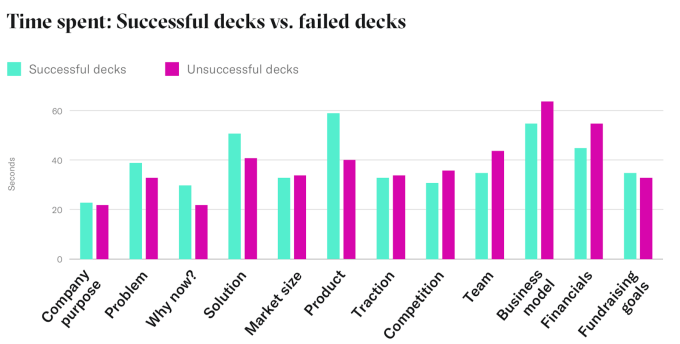

Despite the product taking a more prominent role in the fundraising round, the pitch deck is still a focal point and should be tailored to tell your story in the most effective way, as investors are spending less time evaluating them. On average, investors are spending just 3 minutes and 21 seconds on the pitch deck and the average deck is just 20 slides.

If you are in the process of reevaluating your pitch deck, it could be helpful to make sure your slides feature the right content in the right order. Investors spend nearly 50% more time on the product slides in successful pitch decks and over 18% longer on the business model in unsuccessful pitch decks. Additionally, investors spent more time on solution slides in successful decks than unsuccessful decks.

Ita numbers game… to a certain extent

Another area that could benefit from reevaluation is the number of investors contacted, meetings held and the number of weeks spent in a funding round. Generally speaking, the average amount of investors contacted for successful fundraising rounds is 56, resulting in 26 meetings. On average, successful pre-seed startups will spend 20.5 weeks on fundraising.

When it comes to fundraising, there are diminishing returns for investor outreach. You shouldn&t need to send your deck to more than 60-70 investors and have more than 20-30 meetings. If you&re doing more than that, the ROI on your time just isn&t worth it. Because the current crisis is affecting VCs& willingness to invest, you&re better off finding a small list of investors who are active and targeting your pitch to them. If you&ve reached out to more than 70 investors, but you&re still faced with a wall of &nos& you&re better off pausing your fundraising and addressing the feedback you&ve received so far. For more on when you should quit and reevaluate versus push through you can read my article here (Extra Crunch membership required).

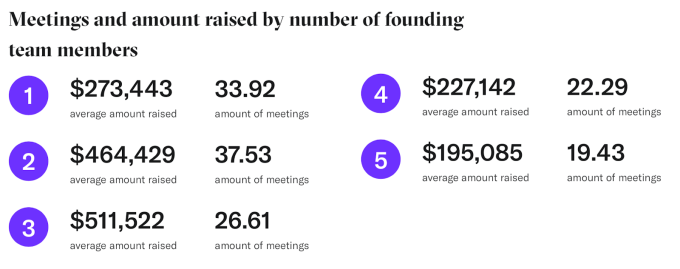

Another area pre-seed startups should evaluate is the number of founders of a company. Our data shows investors still prefer teams of two-three founders, though our data shows that being a solo founder is preferable to having too many founders. For teams of five founders, they averaged earning $195,085 while founding teams of three garnered $511,522.

This may be the right time to find a co-founder. With many people working from home or out of work, this could be the opportunity to take your idea and bring on the technical founder you need. There are online groups and events popping up everywhere in response to social distancing. If you&re worried being a solo founder is going to hold you back, you may want to invest time in those new communities.

Get some perspective

For many startups, especially if you are not in Silicon Valley where a substantial amount of funding happens, the process of fundraising can be very opaque. DocSendpurpose in analyzing this data is to bring some transparency to the process. This in turn provides perspective.

But what founders should do, if they haven&t done so already, is to get some additional perspective. Talk to experts outside your immediate circle of influence. Don&t have a mentor or advisors? Find them. Get a different take on your product idea or the market conditions. Especially now that community events are going virtual, location doesn&t have to hold you back from joining the startup community and finding people to offer feedback on your product or company.

Fundraising is both an art and science. Combining the insights from our data with the benefit of your own community can help you get back on your feet and pitching your company with hopefully a better outcome.

- Details

- Category: Technology Today

Read more: Now may be the best time to reconsider your fundraising approach

Write comment (100 Comments)

Earlier this year, Microsoft made waves in the corporate community by coming out with one of the most ambitious and wide-ranging strategies to reduce carbon emissions from the companyoperations.

Part of that plan was a $1 billion fund that would invest in climate change mitigation technologies — specifically focused on decarbonization. At the time, details were scarce, but it looks like the strategy is becoming a little more clear, with details beginning to emerge about who will be running the show.

According to sources — and a LinkedIn profile search — it appears that Brandon Middaugh is taking point on the investment fund.

Middaugh has been at Microsoft for more than four years and worked as one of the architects of the companyclimate strategy during her tenure at the company. In her previous role as part of the companyCloud Energy and Sustainability team, Middaugh led the distributed energy strategy and was a part of the partnership Microsoft initiated with the East Coast regional transmission organization, the PJM — which manages the power grid for a large swath of the Northeastern and Mid-Atlantic region of the U.S.

It appears that Middaugh is going to be taking point on the deployment of that $1 billion fund Microsoft announced in January, according to people who have discussed the companyinvestments.

At the January event, Microsoft committed to going &carbon negative& by 2030 and said that it would remove by 2050 the equivalent of all the carbon it had emitted into the atmosphere since its founding in 1975. Those commitments are far more aggressive than any made by any other corporation in any industry.

Part of the plan involves expanding the carbon fee the company has imposed internally on its direct emission across its supply and value chains. The $1 billion fund is part of that effort to reduce emissions from suppliers and customers by financing projects and technologies that can reduce emissions with new generation or efficiency technologies, or capture and remove carbon from the atmosphere.

Equity and debt investments have to meet four criteria, including: the ability to drive meaningful decarbonization, climate resilience or other sustainability-related goals; have additional market impacts for future climate solutions; can address Microsoftown climate debt; and have implications for the unequal distribution of climate impacts.

Late last year, Amazon committed that it would move to 100% renewable energy powering its operations by 2030 and that it would achieve net zero carbon emissions by 2040. Meanwhile, Alphabet has been developing renewable energy projects under its moonshot division and has long been an investor in climate mitigation technologies, including the use of renewables to power its operations.

All of these efforts will need to be met by additional work from corporations and financial institutions across every industry if the world is to reduce the most dire effects of dramatic climate change. Already forest fires, flooding and other climate-related catastrophes have led financial investors and insurers to push for better mitigation strategies and to bring climate impacts front and center within corporate strategies.

Microsoft had not replied to a request for comment by the time of publication.

- Details

- Category: Technology Today

Read more: It looks like Brandon Middaugh is heading up the $1B Microsoft climate fund

Write comment (92 Comments)

NASA has tapped SpaceX as the first provider of space-based logistics to deliver experiment materials, cargo and supplies to its lunar Gateway, the agency announced on Friday. This means SpaceX will be among the companies that NASA can turn to when it needs things shuttled via spaceship between Earth and this forthcoming platform, which will orbit the Moon and provide a staging ground for future crewed Moon missions.

The contract means that SpaceX will play a key role in not only NASAforthcoming Artemis Moon missions, which will eventually seek to establish a permanent scientific human lunar presence, but that it also will be involved as NASA begins to work toward extending its reach to Mars, as well. NASA plans to launch multiple cargo supply missions to the Gateway, which has yet to be constructed, with spacecraft designed to go to the station and remain there for between six and 12 months at a time.

The total value of these contracts will top out at a maximum of $7 billion for the entire contract, with a guaranteed minimum of two missions per provider. Other providers will likely be selected, but SpaceX is the first company to be signed by NASA under the agreement. SpaceX is already contracted by NASA to deliver regular supply runs to the International Space Station in Earth orbit using its Dragon cargo spacecraft.

SpaceX is going to be launching a new variant of its Dragon spacecraft called the &Dragon XL& in order to support these missions, and they will be able to carry more than five metric tons to the Moon-orbiting station. They&ll use SpaceXexisting Falcon Heavy craft to launch from Earth for the trip.

In terms of timing, we&ll likely have to wait a while for the first of these missions to actually take off: While the current plan is to launch the first module for the station as early as 2022, it&ll likely only be a few years after that that the station is in any shape to receive regular cargo runs.

- Details

- Category: Technology Today

Page 1106 of 1418

5

5