Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

We&ve had a great decade-long run in SaaS — abundant capital, a thriving economy and a massive existing market shift from on-premise to cloud.

But the good times will end and challenges are coming.

I&m not predicting when it will happen — maybe itthe spread of COVID-19, or perhaps the market recovers and goes on to set new records — but one thing is for sure, recession will come, it always does.

Because a lot of SaaS leaders have never run a business through one, it might be helpful to share some ideas on how to be ready for the inevitable slump. One of the greatest assets a SaaS business has is high-margin, recurring revenue — that should provide more leeway in making changes to get through a downturn than many other types of businesses.

I&ve broken this guide into the macro — things that happen to you, the levers you can impact in your business and some notes on how to keep your stakeholders supportive.

Funding environment

Credit tends to dry up in a recession, but luckily for SaaS, bank debt has never really been available, so itunlikely this makes much difference! The new breed of SaaS debt providers should be able to keep providing credit through a recession, as they understand the real asset of recurring revenue. They may get more conservative in the amount of money they will loan, especially if signups are down and churn is up, but debt should be more available for SaaS than in other sectors. Make sure you know your funnel and install base metrics — these should provide confidence to a lender.

Who knows what&ll happen with VC. There has been so much money raised by new and ever-expanding funds that they may keep investing. Valuations are likely to drop and the world will move more investor-friendly than founder-friendly, and check sizes will drop in line with valuation for VCs to get the same equity for less money. Good business is good business in theory, but &growth at all costs& is harder and more expensive in a recession. Where FOMO (fear of missing out) drives VC in good times, plain-old fear holds them back in bad ones.

Customers and the addressable market

This is nuanced, depending on from where you win customers. Do you save them money over their existing solution? Or cost them more money than how they do it today? Even if their current solution isn&t a good one, the sales pitch for change is much harder in a &batten down the hatches& world than a &shoot for the stars& one.

If your customers are moving from old-world on-premise software, you should be in good shape, or even in better shape as they accelerate the move to SaaS, which saves them money and reduces overhead and capital.

Customers who do what you offer in-house could be a slower, harder sell. This model is already tough — itall about customer timing and being front-of-mind when they are ready — but you can be sure most projects will get shelved or postponed by customers who are reacting to the downturn and its effects on their business. You&ll have to work extra-hard on white-glove onboarding to remove cost and hassle and make sure you have a credible ROI narrative that will rank your product highly on the new short-list of projects that stay approved.

If you&re winning business from customers moving between SaaS tools — like someone swapping out Jira (a SaaS project management tool) in favor of Asana (another SaaS project management tool), just make sure you are the clear &recession-choice& provider, otherwise the flow might go the other way and not only will new sales drop, churn will increase.

Then therethe new project sale — selling a solution that doesn&t currently exist inside your target customer.

Maybe ita new way of doing things, or a product built for an emerging market with low competition (but low awareness, too). Think recurring revenue billing for SaaS: This problem is SaaS-only, and SaaS is still relatively new — itunlikely a customer is using QuickBooks! Or remote team management software — remote teams working on computers all day is a new phenomenon. In a recession, all new projects are going to get ranked by must-do and optional, and the must-do list by impact and speed of impact to the bottom-line. Be able to 100% prove you can deliver value quickly.

Infrastructure costs and credit cards

Therealways some room in the hosting and DevOps setup — you don&t want to take risks — but if you&re like most SaaS companies, cost optimization hasn&t been the top priority because you&re growing and gross margins are already so high. Optimize AWS (or whomever you use) — make sure spot and reserved instances are used where possible, you&re running the appropriate instance sizes and all running instances are actually utilized. Reduce or cut optional monitoring and DevOps tools — therealways a little overlap here.

Audit your credit card statement — do you really need all those SaaS tools? Or better yet, cancel your credit card and get a new one — only re-add the tools you want as the dunning emails come on. I guarantee you&ll find things you&ve been paying for that you didn&t even know about.

In fact, consider getting rid of company credit cards; they get overused and bad habits seep in. When expenses have to be justified to get reimbursed, the number seems to magically drop a little. The burden of proof makes people act more frugally.

Cash and finance

Know your cash. A simple statement, but unfortunately, itrarely the case. You can&t rely on stories, promises and spreadsheets — you need to log in to your bank account multiple times a week. This isn&t hard and you&ll build a gut feel for your cash position and its movements quickly.

Know your cash revenue. Annual and Monthly Run Rate (ARR/MRR) matters, the Profit and Loss account matters, but in tough times, cash is king. If you get low on cash, and think you&re profitable because your P-L says so, you run a serious risk of going out of business.

Cash forecasting is essential — your run rate and your cash often don&t correlate — any pre-payments show up in revenue, but you don&t get that cash every month, so it may already be gone. The same goes for booked revenue that hasn&t paid and sits in aged accounts receivable (AR) — again, revenue but no cash.

Optimize your Deferred Revenue and Accounts Receivable. Try to get more pre-payments without giving too steep a discount — bolstering your cash position. Who owes you money? Chase it. You can&t afford to have a system on — regardless of the margins — if a customer isn&t paying for it.

You must take the &no-surprises& approach to running finance. Any payments above a (low-dollar value in recession world) threshold — the CEO should approve.

People

The team is the most expensive and important asset in every SaaS company. But, if you go out of business, you&ll lose all of these assets, so itessential to make the hard choices in time.

That might mean voluntary or involuntary exits. You could literally ask those who believe in the vision and long-term to raise their hands and tell you who they are. It might mean the end of a bonus structure. It might mean asking people to take salary reductions (itpay cuts or headcount reductions — depending on the team, the leaders need to figure out which puts the business in better shape).

Assess your cultural norms — do people really value free snacks, lunches, a book allowance and so on? You don&t have to zero-out your culture, but therelots of things you can do (like a potluck where everyone brings in food and cooks for each other) that are great fun, build camaraderie and are cheap or don&t cost anything.

Existing customer base

In a recession, these are your most prized assets. You need to show them you are here for the long-haul and are still investing in providing the best product, service and support. Start customer advocacy programs, share more customer success stories and connect groups of like-minded customers together. When new sales drop, retaining existing customers is absolutely essential for the survival of your business. Invest more here during a recession.

Pricing

Many peoplefirst reaction in a downturn is to reduce price. Resist this! First off — it instantly reduces your margins and your free cash flow. Then, if you don&t reduce price for existing customers, you&ve frustrated your install base as well as hurt your bottom line.

Price is a signal — to customers, the market and your team. Businesses that price-cut send a signal that they are in trouble, need cash and are prepared to take a hit to get it. This is not a strategy to attract long-term customers!

Additionally, itdamaging to a business to attempt one-off &recession pricing,& because once you come out of it, itnearly impossible to regain the premium brand and price you once commanded. Price decreasing is a one-way street.

You do have levers — work with customers on payment plans, on ramp-ups or regular usage audits and on pre-payment discounts. You can tweak your pricing model to keep prices where they should be while reducing the burden on your customers — a policy that can easily be retracted post-recession.

Communicate

With customers, with stakeholders, with employees.

Lots of companies are so focused on building the business that they forget to give &business updates& to their community. Thatokay when the updates are great and everything is praiseworthy. But when the world is shaky — regardless of whether your business is or not — all your stakeholders will be nervous. Tell them whathappening, give them confidence that you&re in the details and have a plan to address every area of concern and risk.

Do this early — not when you&re already in trouble — and your community will realize you&re one of the few solid companies with your heads firmly fixed to your shoulders.

Summary

Recessions come and go. This is the first test of the durability and resilience of SaaS companies — but there are sources of power with recurring high-margin revenue. Be conservative. Increase transparent communication. You can, and should, think long-term during a recession: make it through the short-term but don&t destroy your brand, community and company cultural equity to do it.

Whatever you do — remember your customers and employees will remember it when the economy starts growing again. Act responsibly.

This is by no means intended to be an exhaustive list or complete plan — I&d love any recommendations to other articles and guides that might be helpful for our SaaS community in Scaleworks — message me @edbyrne or email This email address is being protected from spambots. You need JavaScript enabled to view it.. Thanks!

- Details

- Category: Technology Today

Read more: The good SaaS times will end and challenges are coming

Write comment (95 Comments)

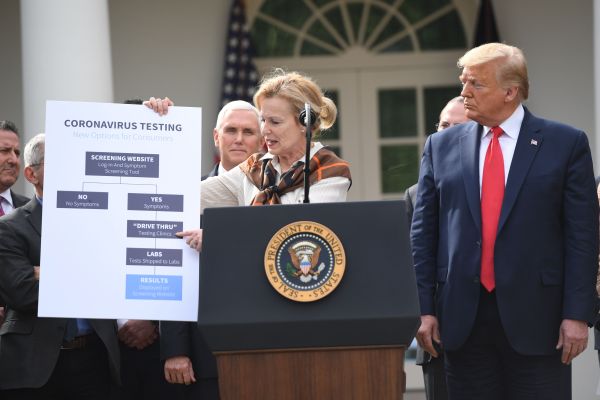

During a press conference at the White House, President Trump today announced that the government is working with Google to build an online screening website for COVID-19.

Update (4pm PT): Turns out, Trump was wrong. ItVerily, not Google, that is building the site. Development is in its early stages and a first rollout will happen in the Bay Area. You can read about whatreally happening here.

The announcement was short on details, but the idea, it seems, is to give users the ability to enter their symptoms and see if they need additional testing. None of this sounds extremely complicated, but according to Trump, Google has 1,700 engineers working on this.

According to Debbie Birx, the White House Coronavirus Response Coordinator, users will have to log into this new screening website, fill out a screening questionnaire and risk-factor questionnaire and then get directed to a &drive through& testing facility.

In some ways, the announcement raises more questions than it answers, though. Itunclear what data Google will collect and whether logging in will be mandatory, for example.

The partnership with Google is part of a larger private sector partnership the White House has set up that also includes Walmart, CVS, Walgreens and others.

We have asked Google for more details and will update this post once we hear more.

Update (2:20pm PT): So far, all we have is this, but itunclear that Verilysite and the one President Trump talked about are the same:

- Details

- Category: Technology Today

Read more: White House teams up with Google to build coronavirus screening site

Write comment (96 Comments)

President Donald Trumpnational emergency declaration, which began just a half hour before the market closed, pushed stocks higher Friday, providing at least temporary relief to shares that have been throttled this week on fears of the COVID-19 pandemic.

Trump detailed several measures under the national emergency declaration, including freeing up federal resources that states can access as they respond to the novel coronavirus outbreak. COVID-19 is a disease caused by a new virus that is a member of the coronavirus family and a close cousin to the SARS and MERS viruses that have caused outbreaks in the past. The spread of the disease has prompted governments and companies to cancel tech, business and automotive events around the world.

All major indices and bitcoin were up earlier today on speculation that the Trump administration would declare a national emergency. The Dow Jones Industrial Average had jumped by 1,200 earlier in the day, but fell some 500 points by the afternoon.

The market roared back in the final moments before close as Trump, along with other health officials and the CEOs of private companies, including Target, Walgreens, Walmart and CVS, outlined plans under the emergency declaration.

In spite of the bump, stock markets sustained one of their worst weeks in recent history. Stocks yesterday recorded their worst day in over 30 years.

At the close, markets were up:

- The Dow Jones was up 1,980, or 9.4%, to 23,182 at the close

- The Nasdaq was up 673 points, or 9.35%, to 7,874.23 at the close

- The S-P 500 was up 230 points, or 9.2%, to 2,711.02at the close

Shares rise

Companies that were mentioned during the presidentaddress saw shares rise in line with the major indices, and in some cases out-pacing them.

During his address in the Rose Garden at the White House, Trump praised the work being done by corporations like Roche, which has developed a diagnostic tool that can more quickly identify infections. Roche shares rose 13% to close at $40.30.

Shares of Alphabet, the parent company of Google, also spiked more than 9% to close at $1,214.27. Trump announced during his address that Google will bebringing a new pre-screening website onlinethat anyone can access to check their symptoms and be directed to testing locations around the country.

Shares of Walmart, Target, CVS and Walgreens were all higher. The companies are partnering with the federal governmentplan to open drive-thru testing sites for COVID-19. Walmart shares closed 9.66% higher, at $114.10; Target shares closed more than 9% higher, at $101.02; and Walgreens was up 12.6%, to close at $46.19.

- Details

- Category: Technology Today

Read more: Stocks spike as President Trump declares national emergency

Write comment (90 Comments)

Industries across the spectrum are struggling to meet the challenges that the current coronavirus outbreak presents. Few, though, are as immediately impacted as the airlines (and all the third-party companies that provide services to them), which have seen an immediate and drastic reduction in demand.

As Delta CEO Ed Bastian noted in a letter to the companystaff today, the company is now seeing more cancellations than new bookings over the next month. And as a result of this, Delta now expects a capacity reduction of 40% in the next few months, &the largest capacity reduction in Deltahistory, including 2001.& Only a few days ago, Delta was looking at a 15% capacity cut.

Unlike some of its competitors, including United and American, Delta says it is also eliminating all of its flights to continental Europe for the next 30 days (and that could still be extended). For Delta, this means parking 300 aircraft. The company has also announced a hiring freeze and is now offering voluntary unpaid leaves, too.

&We&ll be making more critical decisions on our response in days to come,& Bastian writes. &The situation is fluid and likely to be getting worse. But what hasn&t changed is this: Delta remains better-positioned to weather a storm of this magnitude than ever before in our history. We&ve spent a decade building a strong, resilient airline powered by the best professionals in the business. We will get through this, and taking strong, decisive action now will ensure that we are properly positioned to recover our business when customers start to travel again.&

Delta isn&t alone in this move. American Airlines is reducing its international capacity by 34%. Lufthansa already said itplanning to reduce capacity by 50% and potentially grounding all of its A380s or even temporarily halting all operations. Discounter Norwegian has furloughed half of its staff and grounded 40% of its long-haul fleet.

The way things are going, the airline industry will look quite different once this crisis ends. For Delta especially, this is a far cry from keynoting CES and introducing a bunch of new technology solutions. Only a few months ago, after all, the airline industry was still in the middle of a boom. Now, the focus isn&t on shiny new tech but simply making it through the next few months.

- Details

- Category: Technology Today

Read more: Delta Air Lines cuts capacity by 40%

Write comment (90 Comments)In an announcement from the White House Friday afternoon, President Donald Trump said that he has announced an emergency declaration to free up more federal resources that states can access as they respond to the novel coronavirus outbreak.

&I am officially declaring a national emergency. Two very big words,& said Trump.

The order also breaks some of the logjam that had stymied the ability of local and state healthcare organizations to conduct testing for the novel coronavirus.

Typically the powers authorized in the Stafford Act are used to offer assistance during terrorist attacks and natural disasters. During the H1N1 swine flu pandemic in 2009, then-President Obama signed a national emergency declaration that allowed healthcare systems to implement disaster plans in case they became overwhelmed.

That declaration allowed the Department of Health and Human Services to waive certain regulatory requirements for healthcare facilities in response to the pandemic. Specifically, healthcare was able to submit waivers to establish alternate care sites and modify patient triage protocols, patient transfer procedures and other actions when they implement disaster plans, according to a government statement at the time.

The Trump administration had come under fire for not allowing states like California to access Medicaid in an effort to expand coverage. However, the authorization opens up state access to Medicaid more quickly than had happened under the Obama administration during its response to the swine flu outbreak. President Obama waited until October to issue an emergency.

On Thursday, the American Medical Association, the American Hospital Association and the American Nurses Association jointly sent a letter to Vice President Mike Pence, who heads the Coronavirus Task Force, urging the administration to issue an emergency declaration.

Now the president has responded with just such an initiative. In his Rose Garden address, the president also said he was &urging every state to set up emergency operation centers effective immediately.&

The president also praised the work being done by corporations like Roche, which has developed a new diagnostic tool to market that can more quickly identify infections, and Google, which is bringing a new pre-screening website online that anyone can access to check their symptoms and be directed to testing locations around the country.

The emergency declaration also included waivers on interest payments for student loans and a bulk purchase of oil to stock the oil reserve and bail out oil companies hit by the ongoing price war between Russia and Saudi Arabia.

&We had some very old and obsolete rules,& the president said of the regulations that have been circumvented by the executive order.

These rules will allow testing to ramp up across the country in state labs and private facilities.

By using the Stafford Act, the president allows the Small Business Administration to make disaster loans available to eligible businesses and households. It also will allow states to tap Medicaid to finance and expand their capabilities to respond to the spreading COVID-19 pandemic.

At the same time the White House moved forward with an emergency declaration, it had stalled negotiations on the approval of a broad aid package negotiated between Democratic and Republican leadership.

Democrats in the House of Representatives led by Nancy Pelosi negotiated with U.S. Treasury Secretary Steve Mnuchin and White House reps until 4 a.m. on Friday to come up with an agreement. Voting on the deal has been delayed as Republican leadership waits for approval from the White House, according to a report in Reuters.

The House bill would provide free coronavirus testing and two weeks of paid sick leave for workers affected by the virus.

While the bill doesn&t need the support of Republicans in the House, given the Democratic majority, without the support of Senate Republicans, who are in the majority in that chamber, the bill would fail.

Additional economic aid is at the heart of the debate, with Democrats hoping to expand coverage for workers who may not have access to corporate-funded safety nets and Republicans looking to provide tax cuts and financial support to businesses. The president has called for a $1 trillion payroll tax cut, which isn&t supported by congressional membership in either party, according to Reuters.

Stimulus is going to be a necessity if the U.S. is to withstand the economic blows a prolonged outbreak and botched response could bring and calm nervous investors.

&The financial markets and the coronavirus gave us advance warning. We really got a monthnotice on what was coming at us, and we just ignored it,& Claudia Sahm, a former Federal Reserve economist now at the Washington Center for Equitable Growth, told Barrons. &They&re looking ahead and they&re scared. I&m scared.&

- Details

- Category: Technology Today

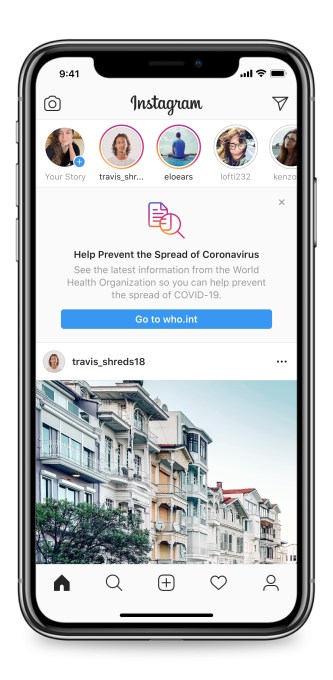

Instagram is embracing its potential as a news source, employing its ubiquity to distribute coronavirus prevention techniques through a new call-out at the top of its homescreen feed. In some countries, Instagram will show a link to information from the World Health Organization and local health ministries, along with a message like this: &Help Prevent the Spread of Coronavirus: See the latest information from the World Health Organization so you can help prevent the spread of COVID-19. — Go to who.int&.

An Instagram spokesperson tells TechCrunch that the notice will start appearing in countries that have seen significant impact from the virus.

Additionally, Instagram is preventing users from searching for COVID-19-related augmented reality effects unless they were made in partnership with legitimate health organizations. This could limit the spread of disinformation or insensitive jokes about the virus. Instagram was already sending false information to fact checkers and listing official health sources atop the search results for coronavirus-related queries.

To help the company stay focused, Facebook is also shutting down the MSQRD app it acquired in 2016 to jumpstart is AR face filters feature. MSQRD will become unavailable on April 13th, though its tech is already fully integrated into Facebook and Instagram.

Meanwhile, on Snapchat, the company prohibits partners from sharing misinformation, relying on its closed platform to prevent the false news hoaxes that have plagued open platforms like Facebook. Snapchat is also highlighting health information shared by its Discover partners, including NBCStay Tuned, Sky News, The Wall Street Journal, The Washington Post, CNN and NowThis. Those include (these links may only open to content on mobile):

Meanwhile, on Snapchat, the company prohibits partners from sharing misinformation, relying on its closed platform to prevent the false news hoaxes that have plagued open platforms like Facebook. Snapchat is also highlighting health information shared by its Discover partners, including NBCStay Tuned, Sky News, The Wall Street Journal, The Washington Post, CNN and NowThis. Those include (these links may only open to content on mobile):

- Washington Post explained the proper way to wash your hands

- WSJ looked at how COVID-19 spread across the world

- SkyNews Explains (UK) breaks down how to self-isolate

These are smart efforts by social platforms that know they might get opened by more people more often than some traditional news sources. With over 1 billion monthly users on Instagram and over 200 million daily users on Snapchat, they have the power to spread vital information and act as a new form of the emergency broadcast system.

- Details

- Category: Technology Today

Read more: Instagram uses its power to put coronavirus tips atop feed

Write comment (97 Comments)Page 1218 of 1416

15

15