Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Verizon said Thursday it will boost investment in network infrastructure, increasing its capital guidance by $500 million, to prepare for the rise in telecommuting and online learning amid the coronavirus outbreak.

Verizon has not seen any measurable increases in data usage, even as some business, schools and other organizations are asking its employees to work remotely, Chairman and CEO Hans Vestberg told CNBC in an interview. He added that the company is monitoring it 24/7 because &patterns can change.& (TechCrunch is owned by Verizon.)

Still, the company is increasing its capital guidance from $17 billion-$18 billion to $17.5 billion-$18.5 billion in 2020. Vestberg said the company would continue to add to its network infrastructure. Verizon said in a statement that the effort aims to accelerate the companytransition to 5G and help support the economy during this period of disruption.

&In these times, itimportant to show the market and the country that there are people investing as well,& he added in the CNBC interview.

Verizon said in a statement that it has been closely monitoring network usage in the most impacted areas and will work with and prioritize network demand to assist needs of U.S. hospitals, first responders and government agencies.

The decision follows an escalating global crisis caused by COVID-19, the coronavirus strain that was declared a pandemic by theWorld Health Organization earlier this week. COVID-19 has wreaked havoc on the stock market, pushing shares lower in every industry, and caused numerous closures, including professional sports games, the cancellation of the NCAA March Madness basketball tournament and Disneyland. Shares of Verizon closed down 3.65%, at $51.20.

- Details

- Category: Technology Today

Read more: Verizon increases network infrastructure investment by $500M

Write comment (97 Comments)

Today after the bell, Slack, a popular workplace communication product, reported its FQ4 2020 earnings, the three-month period ending January 31 2020. The companyresults came in ahead of expectations. However, its shares have rapidly lost altitude in the wake of its news.

In the fourth quarter, Slackrevenue rose to $181.9 million, a gain of 49% compared to the year-ago quarter. Investors had expected Slack to report $174.14 million in top line. The company, therefore, beat on growth. Slack also reported gross margins of 86.6% in the period, a large operating loss of $91.2 million, and negative net income of $89.1 million.

On an adjusted basis the company did better, reporting a non-GAAP operating loss of $23.1 million and a non-GAAP net loss of just $0.04 per share. If investors will continue to allow Slack to lean on adjusted (non-GAAP) metrics long-term isn&t yet clear, but for now it seems to be the case.

But if Slack managed to beat growth expectations, and its adjustedand GAAP earnings per share came in ahead of expectations, why are its shares down so far? Letpeek at its promised growth for its fiscal 2021 — roughly calendar 2020 — to find out.

Great expectations

To get our head around its share price declines, letcompare and contrast what Slack promised for its fiscal 2021, and what investors had in mind. Herewhat Slack has in mind for the current quarter (Q1 fiscal 2021):

For the first quarter of fiscal year 2021, Slack currently expects: Total revenue of $185 million to $188 million, representing year-over-year growth of 37% to 39% [and] non-GAAP net loss per share of $0.07 to $0.06.

And here is the companyfull-year guidance:

For the full fiscal year 2021, Slack currently expects: Total revenue of $842 million to $862 million, representing year-over-year growth of 34% to 37% […] non-GAAP net loss per share of $0.21 to $0.19.

What did investors expect? According to Yahoo Finance figures:

- Q1 fiscal 2021 revenue: $188.37 million

- Fiscal 2021 revenue: $854.45 million

- Q1 fiscal 2021 adjusted EPS: -$0.07

- Fiscal 2021 adjusted EPS: -$0.21

So Slackcurrent-quarter revenue guidance is a tiny bit light, while its full-year revenue guidance is in the middle of expectations. And, the companyper-share profit expectations are a bit better than what investors think it will put up.

Why is the company being punished, then, if its numbers are at least as good as what investors ostensibly had priced in? Because the world has changed in the last two weeks, and Slack had a very rich valuation. Slack is still valued above most SaaS companies in terms of its revenue multiple, even taking into account its post-earnings declines. So it couldn&t just meet expectations, it needed to beat them. And while its Q4 fiscal 2020 (the quarter it just reported) did beat expectations, the companyforward guidance appears to have failed to excite.

Especially when Zoom is reporting rising usage that could convert to revenue, Slackmiddling guidance was just not good enough.

More when it opens tomorrow and we get a better view of the investor response; also, we&ll have an interview with Monday.com about what they are seeing in todaywild work environment. As a spoiler, it seems that the rise in demand for remote-work products isn&t landing equally among the players.

- Details

- Category: Technology Today

Read more: Slack shares plummet 20% after its growth forecast fails to excite investors

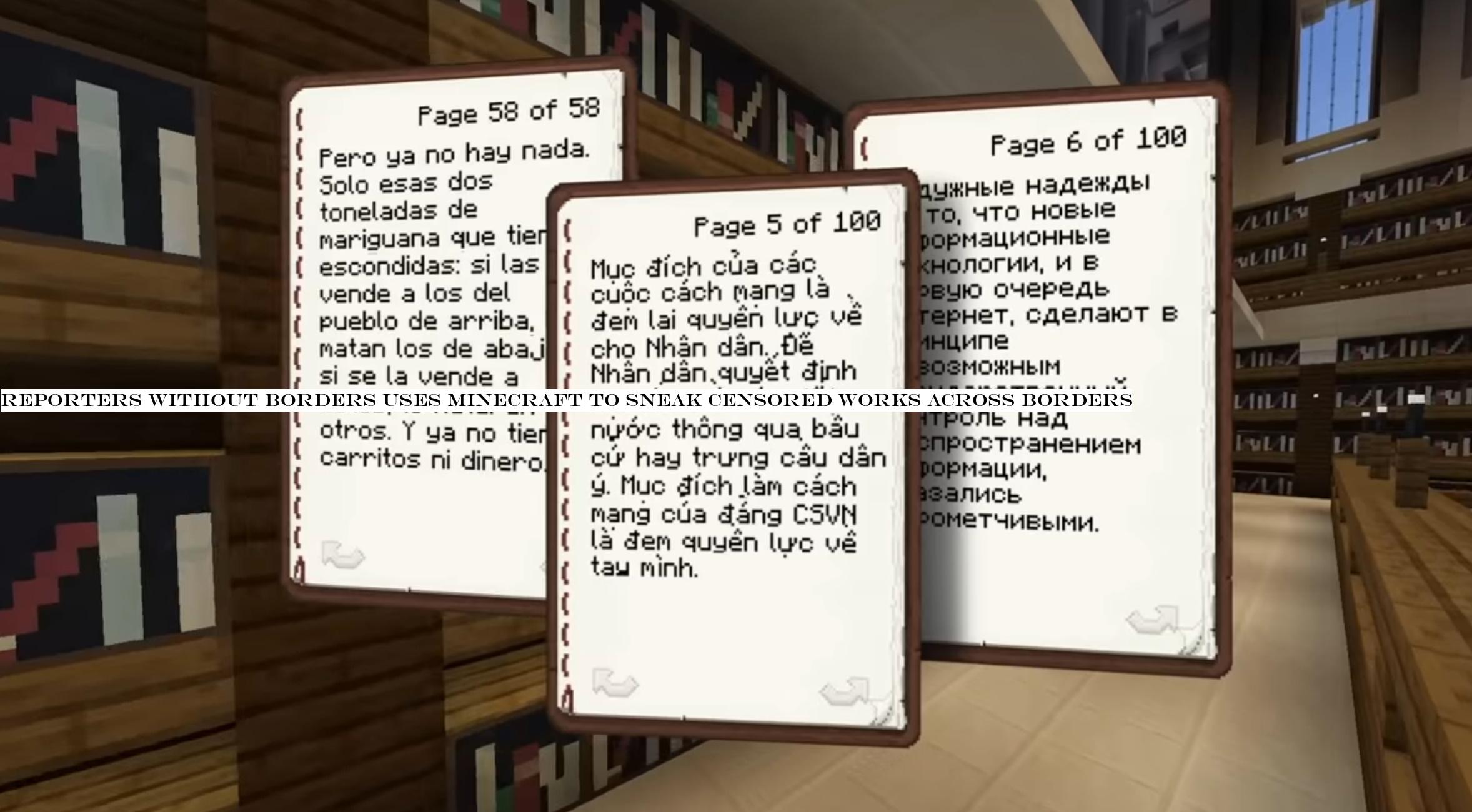

Write comment (93 Comments)Censorship takes many forms, but even the most restrictive countries can&t block every single path for information they&d rather not get in (or out). Reporters Without Borders has identified a surprising new platform for hosting banned content: Minecraft.

The organization, collaborating with reporters, Minecraft pros and, of course, a creative agency, has produced an enormous in-game &Uncensored Library& that hosts a variety of suppressed reportage from places like like Saudi Arabia, Russia and Vietnam.

The structure is a giant neo-classical complex hosted on its own server, which Minecraft players can access freely by pointing their game toward &visit.uncensoredlibrary.com& in the server browser.

The library has a handful of wings, each dedicated to a different country, and each with a series of articles banned in those places, or their authors chased out or even killed. They&re presented in plain text inside Minecraftcraftable books — not exactly the easiest way to take in these important essays and reports, but better than nothing.

There are documents from Nguyen Van Dai in Vietnam, Mada Masr in Egypt, Javier Valdez in Mexico, Alexander Skobov in Russia and arguably the most high-profile casualty to murderous, oppressive regimes in recent history, Jamal Khashoggi in Saudi Arabia. There are only a handful of recent articles at present, but there are also numerous documents describing the state of press freedom and oppression in 180 countries — the RSF Freedom Index.

Of course, this is not secure and private like an end-to-end encrypted chat group. A user accessing the library map might have their nickname, tied to a Minecraft account, be visible to other users, and their logs would reflect the visit. It seems unlikely Microsoft would give up that information to a curious government, but there is a certain risk involved. Fortunately, private duplicate servers can be and are already being established, as well as local copies.

As it stands, the Uncensored Library stands more as a proof of concept that information need not be delivered by traditional means in order to have a potential impact. Minecraft is one of the most popular games in the world, and can be used as an informational and promotional platform as well as just a fun place to hang out and build stuff. What other ways exist to get around the restrictions of governments that would rather their citizens not know the truth?

- Details

- Category: Technology Today

Read more: Reporters Without Borders uses Minecraft to sneak censored works across borders

Write comment (90 Comments)

The European Commission is switching all staff in &non-critical functions& to remote working from next Monday in response to the COVID-19 pandemic.

In an email sent to staff today the Commission writes that president Ursula von der Leyen has activated a business continuity plan that requires all but those in &critical functions& to telework from next Monday.

Previously the EUexecutive body had been implementing limited teleworking for high risk employees such as those returning from Italy for 14 days after their return.

Itnot clear how many Commission staff are defined as carrying out &critical& functions — but it seems likely that thousands will be working from home or remotely next week. In all, the Commission employs around 32,000 people.

Per the email, staff deemed to be carrying out a critical function will already have been informed they are expected to continue to present at work, with &modalities& and &guidelines& to explain working arrangement slated to follow &soon&.

Earlier this week the European Parliament also told staff to prep for mass remote working Monday. Initially vulnerable staff with pre-existing health conditions had been told to telework to limit their risk of being exposed to the novel coronavirus.

The Commission had also already been instructing staff to switch to videoconferencing for missions, meetings and committees where possible.

Belgium, where the Commission is mainly based, has been reporting rising numbers of cases of COVID-19. Today its federal health authority reported 85 new cases today — bringing the total number of confirmed cases in the country to 399.

The Commission itself reported the first cases (two) of COVID-19 among staff earlier this month.

In recent weeks a number of politicians in countries across Europe have also been confirmed as having contracted the novel coronavirus.

- Details

- Category: Technology Today

Read more: European Commission goes teleworking by default over COVID-19

Write comment (93 Comments)

Well, that was terrible.

During the daywild trading session, the Dow Jones Industrial Average (DJIA) dropped by just under 10% in what was the largest single-day percentage decline since the stock market crash in 1987 (when markets were sufficiently scarred to institute failsafe measures for the future, to prevent similar, shocking declines).

Investors shrugged off news that the Federal Reserve was stepping in to offer nearly $1.5 trillion in emergency relief as the major indexes all fell sharply the morning after President Donald Trump addressed the nation to outline the governmentcontinued response to the novel coronavirus outbreak.

Looking at the major American indices:

- The Dow fell by 9.99% or 2,352.60 points to close at 21,200.62

- The Nasdaq tumbled 9.43%, or 750.25, to close at 7,201.80

- The S-P 500 dropped 9.5% or 260.74 points to close at 2,480.64

If you are keeping score on the week, this is the third day of massive declines against a single daygains. Tuesday now feels very long ago.

Why the sell-off?

Itpossible that investors continued their selling streak because any short-term gains from the Federal Reserveefforts to reverse the slide may not be able to bolster the short and long-term health of the American — and global — economy. (The American and global economics are incredibly linked, of course).

&We continue to emphasize that this Fed will act aggressively and in particular that central banks are focused on safeguarding market functioning at this point, and will continue to provide liquidity in scale,& Ebrahim Rahbari, director of global economics at Citi Research, told CNBC. &However, despite the sharp initial risk rally, we think these measures will still not be sufficient to durably stabilize market sentiment yet in light of credit concerns and escalating health concerns.&

Meanwhile, more American institutions are being disrupted by efforts to mitigate the spread of the novel coronavirus sweeping the country. Broadway was shut down, major sports events have all been canceled and entire seasons are being put on hold.

Airlines and the travel industry were hit particularly hard today with shares of United Airlines down 12.26%, Delta off 21% and American Airlines seeing a 17.28% drop as of market close. Airlines are bearing the brunt of a decision issued Wednesday evening by President Trump to ban travel between the U.S. and Europe for the next 30 days. Today, airlines started canceling flights. Delta said it will temporarily cancel flights between cities like Amsterdam and Orlando, Portland and Salt Lake City, as well as flights to Paris from Cincinnati, Raleigh/Durham and Indianapolis.

Itagainst that backdrop that investors took to the hills yet again today. And all this ahead of the country being ready to truly ramp up its COVID-19 testing regime.

Not even cryptocurrencies were safe from the rout. Bitcoin and all of the other major cryptocurrencies suffered their worst declines in years as investors also sold heavily. SaaS shares were down over 8%, and after-hours, Slack earnings failed to excite and its equity is being sold off. In short, if you were looking for a silver lining, there isn&t one today. (Unless you shorted oil a month ago.)

- Details

- Category: Technology Today

Read more: Stocks dive on Dow’s worst day since 1987, tech crashes and Bitcoin is no haven

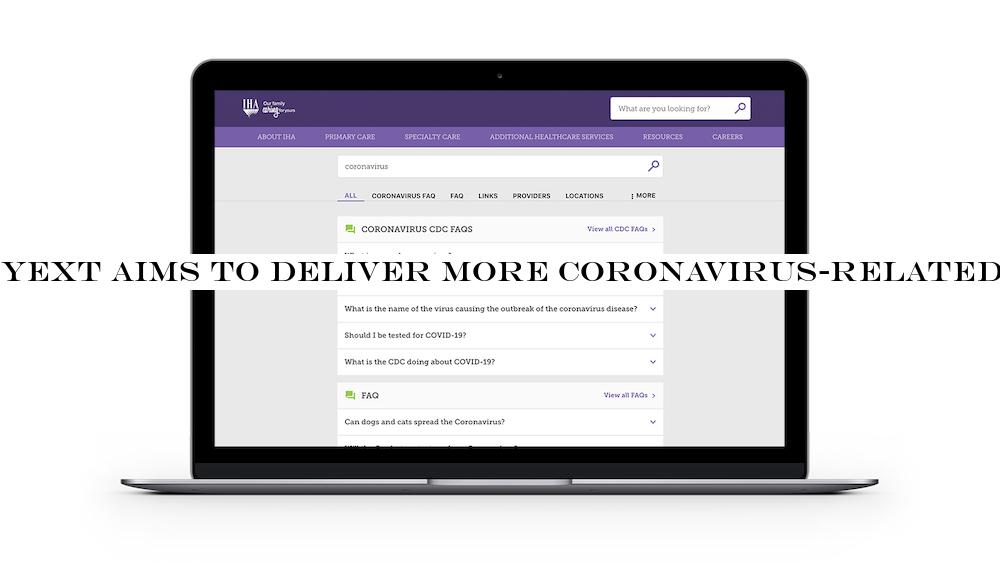

Write comment (93 Comments)Yext says that in response to the COVID-19 pandemic, itmaking its Yext Answers site search product free for 90 days.

You might not see an obvious connection between site search and a worldwide pandemic. You might even think this sounds like a marketing gimmick. But Yext CEO Howard Lerman said that for the past 10 days, the company has seen a spike in coronavirus-related searches across sites that use Yext Answers.

After all, Lerman said Yext has a lot of customers in the healthcare industry, such as the IHA medical group. But even beyond that, companies are getting related questions, whether ita hotel getting asked about their cleaning procedures, or an airline being asked whether itsafe to fly or a vodka company getting asked about whether vodka can be used as hand sanitizer.

Businesses could try to answer those questions on a single web page or blog post, but thatprobably not going to be comprehensive. Yext Answers offers a way to present and save this information in a much more structured way, so that a visitor can jump to the exact answer that interests them. In addition, it provides data on what visitors are searching for, so companies can answer the questions that people are actually asking.

Yext is also offering a free plugin that includes frequently asked questions about the coronavirus, with answers sourced directly form the U.S. Centers for Disease Control and Prevention.

&We have a product that could be pretty useful right now,& Lerman said. &We don&t want people to be getting wrong answers in the time of a global pandemic.&

He added that the company would normally charge around $100,000 for three months of Yext Answers. However, the free offering will be limited to 1,000 entities (which can be FAQs, locations or anything else), and Lerman said most paying customers are already using more than that.

While the product is free, the company will still schedule an initial setup call with a Yext administrator and provide ongoing email support. You can read more on Yextnew website.

- Details

- Category: Technology Today

Read more: Yext aims to deliver more coronavirus-related answers by making its site search free

Write comment (93 Comments)Page 1228 of 1416

16

16