Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Chattermill, the London startup that offers what it calls a &customer understanding& platform that uses machine learning to gain scalable insights into customer feedback, has raised $8 million in Series A funding.

Leading the round is DN Capital, alongside Ventech and btov Partners. Silicon Valley Bank also participated, in addition to a number of angel investors including Matt Price (Senior Vice President at Zendesk), and Nilan Peiris (VP Growth at Transferwise). Existing investors Entrepreneur First, Avonmore Developments and 2be.lu also followed on.

I&m also told that Price, who previously led Zendeskgrowth in EMEA, will join the Chattermill board as Non-Executive Director.

Co-founded by Mikhail Dubov and Dmitry Isupov in 2015 while going through the company builder program run by Entrepreneur First, Chattermill was born out of a frustration that it can take weeks or months for customer research to yield any quality insights, which would then be out of date by the time it reached decision-makers and action could be taken. Like many problems of scale, the pair believed machine learning could be an important part of the solution, coupled with an accessible user interface that surfaces customer feedback across multiple channels in an actionable way.

Since then, Chattermillplatform has been used by a number of high-growth companies, such as HelloFresh, Uber, Deliveroo, and Zappos. London fintech darling Transferwise was also an earlier customer — so perhaps unsurprising that its VP of Growth is now an investor.

Comments TransferwisePeiris: &Chattermill enables our team to take customer insights deeper than ever before and focus on the key factors that make a difference to our users and drive our growth. I&ve seen first-hand the value a product like Chattermillcan add to a company and thatwhy I decided to invest in this round&.

Agonistic to where the customer feedback is generated, Chattermill integrates with lots of third-party software, aggregating various feedback such as surveys, reviews, support tickets, and social media.

&We have built a large library of pre-built connections to the most popular customer feedback systems such as SurveyMonkey, Trustpilot, Zendesk and Salesforce,& explains Chattermill co-founder Mikhail Dubov.

&A new customer would usually connect a few of these data sources to start with. We then build a model to understand their customer experience from both the data we see and knowledge already embedded in our system. Once this is done, we can start delivering analytics and insights directly to their users in real time and with high accuracy, enabling businesses to make better-informed decisions at a faster speed and scale&.

Asked what assumptions Chattermill got right after raising its seed round in December 2017, Dubov says two key strategies have panned out well. One was to go after &customer-focused& businesses at the start, and the other was to double down on the depth of insights and the productease of use versus &over-investing& in specific machine learning technologies.

&This meant our offering became even more powerful as NLP made a huge step forward in the last two years with models such as GPT and BERT,& Dubov explains. &We were able to swap out parts of our model to improve quickly rather than being attached to a specific architecture&.

However, not everything was foreseen, and Dubov says he didn&t anticipate how much the tech landscape around customer experience would change. &With the acquisitions of Qualtrics and IPOs from Medallia and SurveyMonkey, we now see a lot more attention to the sector from both customers and investors,& he says. &We also see a lot more interest in extracting insight from customer conversations via chat and voice than we did two years ago&.

- Details

- Category: Technology Today

HealthJoy, a platform designed to make it easier for employees to use their healthcare benefits, has raised $30 million in Series C funding led by Health Velocity Capital. Returning investors also participated, including U.S. Venture Partners, Chicago Ventures, Epic Ventures, Brandon Cruz and Clint Jones. This brings HealthJoy total funding so far to $53 million.

By integrating with healthcare service providers and partnering with benefit consultant agencies, HealthJoy simplifies the process of finding and using benefits. Its features include an AI-based virtual assistant and healthcare concierges. The startup says it has a monthly login rate of 33% and that its clients, which now includes 500 employers, see a tenfold increase in the employee use of benefits, including telemedicine.

Since TechCrunch covered HealthJoySeries B round last year, the company has launched two new services. One is a price transparency tool called HealthJoy Rewards that allows companies to provide incentives for employees to use more cost-efficient services.

&For example, an MRI in Chicago can vary in price from around $500 for an independent clinic to around $3,500 in a hospital system,& HealthJoy founder and CEO Justin Holland told TechCrunch. &Our rewards platform allows companies to customize the incentive, but we provide nearly 100 recommendations. We&re showing an amazing ROI for companies that have adopted the program since we&re targeting high-cost procedures.&

The second new service is called HealthJoy EAP, an employee assistance program that Holland says is a priority for further development. It gives 24/7 access to short-term counseling, with several sessions available for free.

&Addressing mental heath is of extreme importance for companies in todayworld. Access to traditional counseling is on decline in many rural areas due to lack of access. In cities, costs have risen so many users are priced out of the market,& he says.

The funding will also be used to improve HealthJoyvirtual assistant, develop new services, integrate with more partners and aggregate data. HealthJoy plans to add 200 employees in its Chicago office during 2021, with the goal of doubling its engineering team. Future plans include working with more small- to medium-sized businesses and a potential partnership to serve Medicare recipients.

Other startups focused on employee benefits include League, Catch and Collective Health. Holland says HealthJoy integrates with, instead of competing with, benefits administration platforms and differentiates by being able to work with any benefits package.

Health Velocity Capital partner Saurabh Bhansali will join HealthJoyboard of directors. In a press statement, Bhansali said &HealthJoy offers proven technology solutions to help navigate employees through our nationcomplex and costly healthcare system, one that costs US employees over $1.2 trillion each year. Healthjoy has shown that it can deliver substantial cost savings to employers while simplifying the employee healthcare experience.&

- Details

- Category: Technology Today

Read more: Created to help employees figure out health benefits, HealthJoy raises $30 million

Write comment (99 Comments)Cobee, a Spanish fintech startup that has developed an employee benefit management app and accompanying card, has closed €2.1 million in &pre-Series A& funding.

The round was co-led by Speedinvest, and Target Global. Other backers include Chris Bouwer (co-founder of Adyen) and existing investors Encomenda Smart Capital, BStartup (Banco Sabadell), Lanai Partners and Abac Nest.

Founded in 2018 by Borja Aranguren and Daniel Olea, Cobee aims to help employees &leverage better economic performance& from their salary via a range of employee benefits and discounts offered through the platform. These are managed within the Cobee app and redeemed through use of the Cobee payment card.

The draw for companies signing up is that Cobee already claims its platform has higher engagement than many existing employee benefit programmes. And by being a fully digital and automated solution, there is considerably less administration needed to manage the programme.

&We realized that there is an increasing number of solutions that are being sold as benefits or products to the end employees through their HR department (gyms, insurance products, perks, vouchers, salary sacrifice formulas, etc.),& Cobee co-founder and CEO Borja Aranguren tells TechCrunch. &This, on the one hand, means administrative hassle for the HR departments to manage all the different providers and processes and, most importantly, on the other hand, brings a totally fragmented and unclear value proposition for the employee&.

With this problem in mind, Aranguren and Olea set out to build Cobee, which the pair describe as a fintech HR solution that empowers employees to consume their compensation and benefits on-demand.

With this problem in mind, Aranguren and Olea set out to build Cobee, which the pair describe as a fintech HR solution that empowers employees to consume their compensation and benefits on-demand.

&All our efforts are focused on making employees feel happy about their benefits, trying to unify the value proposition in an understandable and easy to use formula,& Aranguren explains. &For the companies, we offer an easy-to-use SaaS platform to configure their benefit offering and upload their employees. For the employees, it is an app and a payment card to consumer those benefits as they like, with funds coming from a company subsidy or from their own salary&.

The current Cobee offering includes benefits like meals, transportation, childcare, health insurance and training courses. Additional options, such as gym membership, are said to be coming in the next few months.

&Our product can cater for companies of all sizes, from SMEs or startups to large corporations of any sector,& adds Aranguren. &However, our main target segment are those companies ranging between 50 to 5,000 employees. We have customers and users like Petronas, Avis Budget Group, Auto1 Group, Opinno, Glovo, and Willis Towers Watson&.

Meanwhile, Cobee says it will use the new funding to &scale up its business model& in Spain and expand into international markets. To support its mission to become a European category leader, the company plans to strengthen its team and enhance its platform by integrating new products and benefits.

The business model is straightforward, too: Cobee charges companies a SaaS fee per active employee. &We follow a pure success-based approach and we only win if the employees win, which, after all, makes the companies win,& says the Cobee CEO. &Besides that, we leverage purchasing volumes to build a marketplace that we can monetize and that also allows us to create savings that can be transferred to our end customers/employees&.

- Details

- Category: Technology Today

Read more: Spain’s Cobee raises €2.1M for its employee benefits app and payment card

Write comment (90 Comments)

As Indian startups begin to make inroads in the world of SaaS, Microsoft has taken notice. The American tech giant today launched 100X100X100, a program aimed at business-to-business SaaS startups.

Microsoft said Monday that 100X100X100 will bring together 100 companies and 100 early and growth startups. Each committed company will spend $100,000 over a course of 18 months.

&This initiative will help build scale and create amazing opportunities for startups. Businesses can now fast-track their digital journeys through easy adoption of enterprise-grade solutions,& said Anant Maheshwari, President of Microsoft India, in a statement.

Each startup participating in the program will also have access to prospective customers at Microsoft industry and customer events. Participants also get access to Microsofttechnology platform, and guidance in fine tuning their business and expansion models.

Microsoft is not a new face in Indiastartup ecosystem. The company runs Microsoft for Startups that allows early stage B2B startups to use the companyAzure marketplace and enterprise sales team. Early last year, the company also expanded M12, its corporate venture fund, to India.

The companyglobal rivals Google and Amazon are also actively helping startups in India, sponsoring countless events and bandying out a range of goodies including thousands of dollars of credit to use their cloud platforms.

The idea is simple: If the bets work, these startups are already a customer and their solutions could be beneficial to several tens of thousands of other customers. And ita safe time to make these bets.

In recent years, scores of startups have emerged in India to build SaaS software following the success of firms such as Freshworks, valued at $3.5 billion, and CleverTap. Since SaaS startups are not building hardware, or disbursing loans, they often have the best profit margin.

Shekhar Kirani, a partner at Accel, told TechCrunch in a recent interview that his biggest frustration was not seeing many more entrepreneurs build SaaS services. &Anyone with some coding skills and a cheap laptop can build a service and sell to the world,& he said.

At a recent SaaS focused event, Godard Abel, chief executive of business marketplace G2, said that India was already among the top five nations for active participations for development of new business services.

As for Microsoft, expect several more announcements this week as its chief executive, Satya Nadella, appears at companyflagship conference in the country today and tomorrow.

- Details

- Category: Technology Today

Read more: Microsoft launches 100X100X100 program to help Indian B2B SaaS startups

Write comment (99 Comments)Target Global, the pan-European venture capital firm headquartered in Berlin, has raised a new €120 million early-stage fund, following what it claims was only 3 months of fundraising.

Dubbed &Early Stage Fund II&, the new vehicle will see the firm continue to back early-stage tech companies across Europe and Israel, leading and co-leading seed and Series A rounds. It also has a later-stage growth fund and a dedicated mobility fund, and in combination Target Global currently has over €800 million in assets under management.

&Our ‘Early Stage Fund II& will pretty much follow the same strategy as our ‘Early Stage Fund I&; same team, same size, same investment strategy,& Shmuel Chafets, General Partner and Vice-Chairman at Target Global, tells TechCrunch.

&We had long debates around fund size, and despite it being oversubscribed, we opted to keep it at the original €120 million, which we believe is optimal for European early-stage at the moment and will also us to both deliver venture returns to LPs and give our founders the time and attention that early stage companies need&.

To that end, Target Global — which has a 50-person team across offices in Berlin, London, Tel Aviv, Moscow and Barcelona — says it will continue to focus on startups that are disrupting &truly European, trillion-Euro industries,& citing retail, financial services, food, mobility, healthcare, and manufacturing organizations, and the application of technologies such as SaaS, online marketplaces and e-commerce, and AI.

&Category leaders& that the VC has already backed include Auto1, Delivery Hero, Wefox, TravelPerk, and Rapyd.

&We like to invest in companies that target huge markets and with great teams that have relevant experience for the problem they are solving and that show durability,& adds Chafets. &It is very rare to have a team in the pre-A stage that really has all the answers around product-market-fit and technology. Most companies go through good and bad times, we try to find the founders that would go the distance&.

Meanwhile, Target Global is also announcing that Dr Ricardo Schäfer has been appointed as a new partner for Early-Stage Fund II. He&ll be leading the firmearly-stage investments in its London office. Described as a serial angel investor and an early backer of Revolut, Schäfer was most recently part of Seedcampinvestment team, as well as a Venture Partner with Cherry Ventures.

&We are happy to strengthen our London team with such an experienced and successful early-stage investor,& says Alex Frolov, General Partner and CEO at Target Global, in a statement. &With his focus on fintech and proptech, and a hands-on, entrepreneurial approach, we feel that itan excellent match both for our Target Global investment strategy and our culture&.

- Details

- Category: Technology Today

Read more: Europe’s Target Global raises new €120M early-stage fund

Write comment (97 Comments)Kenya based B2B e-commerce startup Sokowatch has raised $14 million in Series A funding toward its mission of revamping supply-chain markets for Africainformal retailers.

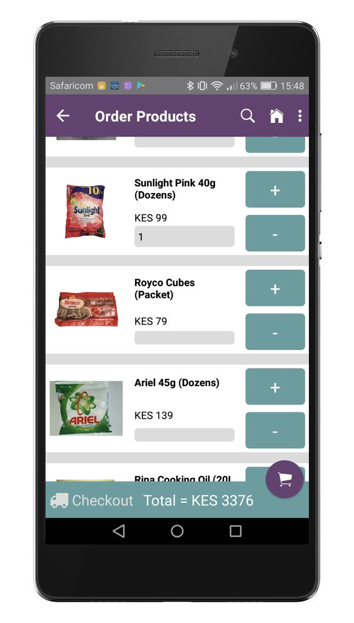

From Nairobi, the company has created a platform that connects merchants directly to local and multinational suppliers — such as Unilever and Proctor and Gamble — and digitizes orders, payments and delivery-logistics.

Since launching in 2016, and raising a $2 million seed round in 2018, Sokowatch has expanded within Kenya and into Rwanda, Tanzania and Uganda.

With its Series A, the startup plans to broaden its client services — from working-capital to data-analytics — and target new African markets, according to CEO Daniel Yu.

Sokowatch also doesn&t rule out using its infrastructure to someday enter business-to-consumer online retail.

For the moment, the startupprimary business focus is to reduce costs and increase profit margins for small merchants.

&We&re looking to build out the largest B2B e-commerce network across Africa,& Yu told TechCrunch on a call.

Informal retail is still king in Africa — even with the emergence of shopping malls and well-funded e-commerce ventures, such as Jumia.

The size and potential of the continentinformal sector has captured the attentionofeconomists and startups.GDP revisions in several African countries have revealed outdated statistical methods were missing billions of dollars in economic activity. And one estimate by The International Labor Organization places more than two-thirds of Sub-Saharan Africanon-agricultural employment in the informal economy.

On the number of shops in that space, a 2016 study by global consultancy PwC estimated 90% of sales in Africamajor economies come through informal channels, such as markets and kiosks.

By Yuaccount, too many of Africalocal merchants are sacrificing capital and incurring opportunity cost due to inefficient supply-chain.

Sokowatch is shifting that scenario, according to its CEO, and now serves over 15,000 small retailers across its operating areas.

&We…estimate that we save merchants at least 20% on supply-chain costs for the goods we supply,& said Yu.

Sokowatch offers retailers an app to order products from its partner suppliers and maintains a fleet of vehicles, primarily three-wheel tuk tuks, for delivery.

Sokowatch offers retailers an app to order products from its partner suppliers and maintains a fleet of vehicles, primarily three-wheel tuk tuks, for delivery.

&We handle all of our last-mile logistics exclusively ourselves,& said Yu.

The startup is also generating additional enterprise services. &As part of the product we are developing other tools for merchants to directly manage other aspects of their business, especially when it comes inventory and overall sales,& said Yu.

The data analytics Sokowatch creates for clients is also opening up working-capital solutions.

&We&ve been able to use that data to offer in-kind credit lines to many shops that can&t gain it from banks,& said Yu.

Quona Capital led Sokowatch$14 million Series A round, joined by Amplo, Breyer Capital, Vertex Ventures, Timon Capital and repeat investor 4DX Ventures.

The startup joins other B2B oriented ventures that have drawn significant capital over the last 12 months.

The startup joins other B2B oriented ventures that have drawn significant capital over the last 12 months.

Kenyan startup, and B2B food distributor, Twiga Foods raised $30 million in 2019 and announced it would expand to West Africa.

In August, Nigerian trucking logistics startup Kobo360 raised a $20 million Series A backed by Goldman Sachs. In November, East African on-demand delivery venture Lori Systems hauled in $30 million supported by Chinese investors and another Kenyan logistics company, Sendy, raised $20 million this January backed by Toyota.

Sokowatch wouldn&t name which countries in Sub-Saharan Africa iteyeing for expansion. The companyCEO did confirm the startup could someday use the advantages of its platform to offer 3PL services or sell online directly to consumers in Africa.

&Itwithin the power of our networks to do so& said Yu. &At the end of the day, we want to be the channel — both digital as well as physical — for transforming access to goods and services for these communities.&

- Details

- Category: Technology Today

Read more: Sokowatch raises $14M to digitize Africa’s informal B2B supply-chain

Write comment (97 Comments)Page 1374 of 1408

13

13