Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.Yesterday we explored what the SaaS world thinks about churn.

A cohort of SaaS executives surveyed by Gainsight are expecting medium-bad churn (our take on their reported forecasts); select software companies will see booming demand; and the impact of churn wont be felt evenly around the world, leaving some markets stronger than others, offering SaaS startups and their public brethren a chance to grow.What mattered (read the piece if you have time) is that there is a general expectation that churn will rise as the worlds economy slips in the face of a historic pandemic and its constituent city- and country-wide shutterings.

In time, we should see the impact of rising churn in public earnings reports, lower startup valuations, slower growth curves, and changing go-to-market motions.But, something that we can see today is a falling growth rate among SaaS companies focused on both other businesses and consumers.

This is thanks to new data from ProfitWell, a Boston-based software company that helps other firms track their subscription businesses and work to reduce churn.

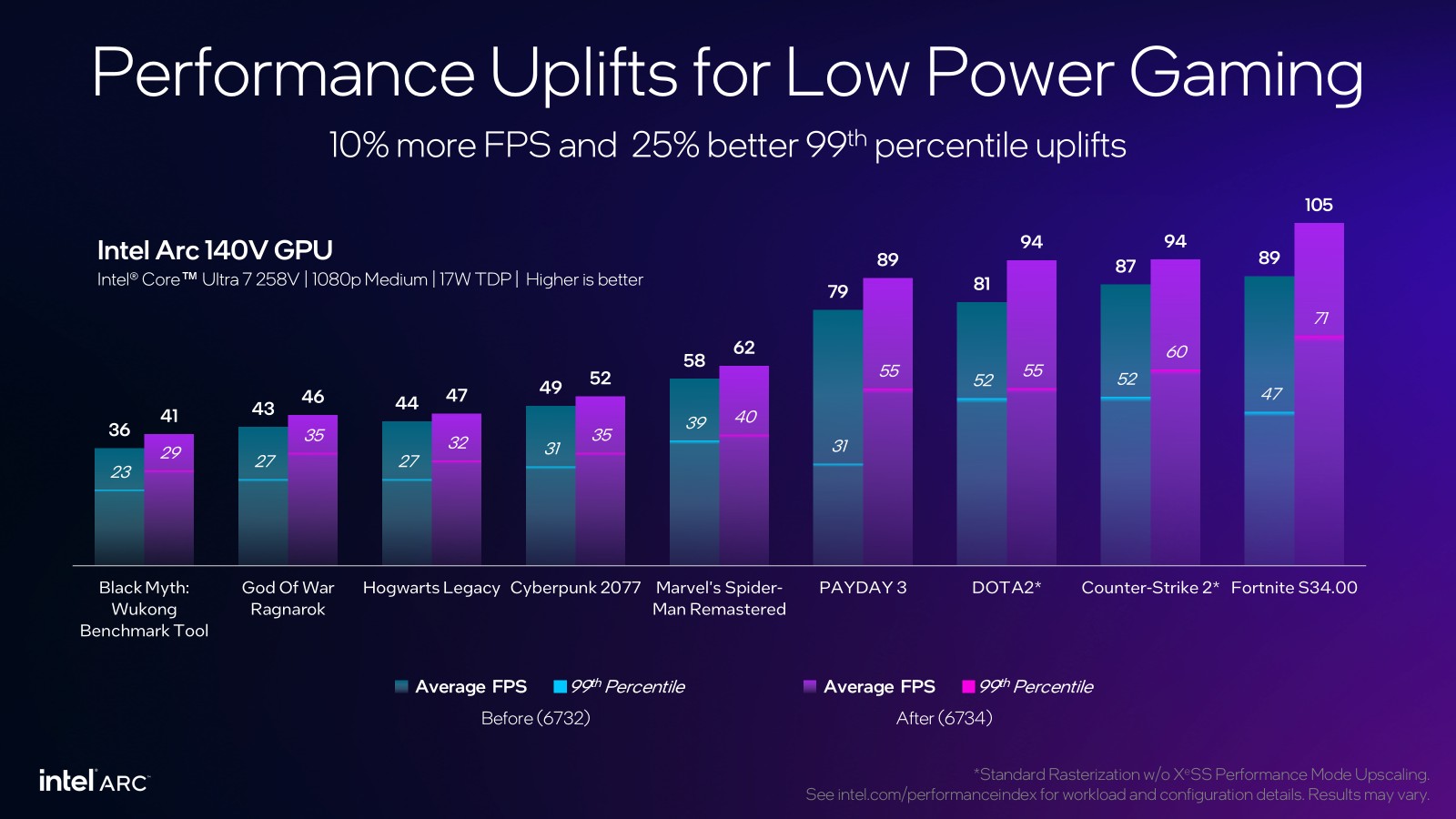

A set of charts provided to A Technology News Room detail how the growth rate of SaaS companies, in both B2B and B2C, are falling.

Add in a rising churn expectation for the modern software industry, and the market could be in for SaaSs first patch of hard times in recent memory.According to ProfitWell CEO and co-founder Patrick Campbell, the following data is predicated on just under 20,000 subscription [and] SaaS companies that range from small startups to Fortune 50 companies.Given that we tend to focus a bit more on the B2B world, well start there.

The following chart tracks growth amongst business-focused SaaS startups that ProfitWell has data on.

Try to spot where the trendlines change, and then check the data associated with the turn:

14

14