Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

StockMarket

Business

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Charles and Candace Nelson traded their investment banking careers in Silicon Valley for the sweet, sweet life as captains of the cupcake and confectionery chain Sprinkles.

Now they&re putting both their consumer and brand development skills and former investment banking chops to work at CN2 Ventures, a new firm they&re setting up with the goal of pulling in $25 million to invest, incubate and support new business ideas.

The firm already has three businesses in its portfolio and two others that itstill in the process of launching, said Charles Nelson.

Therethe pizza chain, Pizzana; the kids playspace, Play 2 Progress; and the direct to consumer clothing brand, Willy California.

&We&re focusing on retail and consumer areas,& says Charles Nelson. &Both branded retail and doing some direct to consumer. Our plan is to raise a fund… ideally around $25 million if we can.&

The couple sees their investment sweet spot in the marriage of technology and retail. Itthe space where they found their initial success at Sprinkles — which included high-tech touches like pre-ordering and customization through its touchscreen services at its retail locations.

&We started as brick and mortar people,& says Candace Nelson. &Even as D2C… it feels soulless unless you experience the brand physically in some way.&

So far, the firm has been taking large equity stakes in the businesses itbacking — in part because it can, but also because these portfolio companies can almost be seen as subsidiaries operating under the larger CN2 Ventures umbrella.

Minority investments will be an option, according to Charles Nelson, but the company intends to be targeted in the types of investments it makes. For the most part, the defining characteristic for both founders of the firm is that they&re true believers in the businesses they&re backing.

&Candace and I will never invest in something that we aren&t super passionate about and a brand that we don&t love.&

Candace Nelson points to the coupleinvestment in Pizzana as an example. &We joked post-Sprinkles, ‘no more food businesses,& but we met Daniele [Uditi] and he totally turned our minds,& she said.

- Details

- Category: Technology Today

Who fact-checks the fact-checkers? Did Trump call coronavirus the Democrats& &new hoax&?

Those are the big questions emerging from a controversial &false& label applied to Politico and NBC News stories by right-wing publisher The Daily Caller. Its Check Your Fact division is a Facebook fact-checking partner, giving it the power to flag links on the social network as false, demoting their ranking in the News Feed as well as the visibility of the entire outlet that posted it.

Critics railed against Facebookdecision to admit The Daily Caller to the fact-checking program last April due to its history of publishing widely debunked articles. Now some believe their fears of politically biased fact-checks are coming true.

Image via Judd Legum

This week, Check Your Fact rated two stories as false. &Trump rallies his base to treat coronavirus as a ‘hoax& & from Politico, and &Trump calls coronavirus Democrats& ‘new hoax& & from NBC News, as highlighted by Popular InformationJudd Legum. The fact-check explanation states that &Trump actually described complaints about his handling of the virus threat as a ‘hoax&. &

Trump had said at a rally (emphasis ours):

&Now the Democrats are politicizing the coronavirus. You know that, right? Coronavirus. They&re politicizing it. We did one of the great jobs . . . They tried the impeachment hoax. That was on a perfect conversation. They tried anything, they tried it over and over, they&ve been doing it since you got in. Itall turning, they lost, itall turning. Think of it. Think of it. And this is their new hoax. But you know, we did something thatbeen pretty amazing. We&re 15 people [cases of coronavirus infection] in this massive country. And because of the fact that we went early, we went early, we could have had a lot more than that . . . we&ve lost nobody, and you wonder, the press is in hysteria mode.&

Ithard to tell exactly what Trump means here. He could be calling coronavirus a hoax, concerns about its severity a hoax or Democrats& criticism of his response a hoax. Reputable fact-checking institution Snopes rated the claim that Trump called coronavirus a hoax as a mixture of true and false, noting, &Despite creating some confusion with his remarks, Trump did not call the coronavirus itself a hoax.&

Image via Judd Legum

Perhaps Politico and NBC News& headlines went too far, or perhaps the headlines fairly describe Trumpcharacterization of the situation.

But the bigger concern is how Facebook has designed its fact-checking system to prevent other fact-checking partners from auditing the decision of The Daily Caller.

When asked about this, Facebook deflected responsibility, implying the audit process wouldn&t be necessary because all of its fact-checking partners have been certified through the non-partisan International Fact-Checking Network. This group publishes ethics guidelines that include an accuracy standard that requires checkers &maintain high standards of reporting, writing, and editing in order to produce work that is as error-free as possible.& Checkers are also supposed to follow criteria for determining story accuracy, and can apply mid-point labels like &Partly False& or &False Headline,& which The Daily Caller didn&t use here.

Facebook tells me that because it doesn&t think itappropriate for it to be the arbiter of truth, it relies on the IFCN to set guidelines. It also noted that therean appeals process where publishers can reach out directly to a fact-checker to dispute a rating. But when I followed up, Facebook clarified that publishers can only appeal the fact-checker that labeled them, and can&t appeal to other fact-checkers for a second decision or audit of the original label.

That leaves very little room for controversial or inaccurate labels to be rolled back. A fact-checker would have to be formally rejected by the IFCN for violating its guidelines to lose its status as a Facebook partner.

If Facebook doesn&t want to be the arbiter of truth, it should still establish a process for a quorum of its fact-checking partners to play that role. If consensus amongst other partners is that a label was inaccurate and a story might instead warrant a lesser label or none at all, that new decision should be applied. Otherwise, mistakes or malicious bias from a single fact-checker could suppress the work of entire news outlets and deprive the public of the truth.

- Details

- Category: Technology Today

Read more: Facebook fact-check feud erupts over Trump virus ‘hoax’

Write comment (92 Comments)

Stack Overflow has long been the Q-A site of choice for developers. But while thatwhat most people know the company for, it has also built out a jobs site and Teams, its private Q-A service for enterprise clients, over the years. Now, itlooking to capitalize on that and kickstart growth of Teams, especially, under its new CEO, Prashanth Chandrasekar.

Chandrasekar, a former investment banker and Rackspace exec, took over as Stack OverflowCEO. Teresa Dietrich, who was previously at McKinsey New Ventures, joined him at the beginning of the year as the companychief product officer. Ahead of todayTeams product update, which mostly includes a number of new integrations, I sat down with Chandrasekar and Dietrich to talk about the companyplans for the future and the role Teams will play in that.

Chandrasekar tells me that Stack Overflow itself, even after 12 years, has about 50 million monthly users. In addition, another 70 million each month visit the rest of the Stack Exchange sites around culture, science and other topics.

The Stack Overflow jobs product accounts for about half of the companyrevenue, he also noted. &Thatthe very steady business that has existed for all of the entire duration of the companylife,& he said. Ads and the Teams product split the remaining 50%, but itthe two-and-a-half-year-old Teams service that is seeing the strongest growth now, with revenue nearly doubling year-over-year. &Our expectation is that in the next couple of years, it&ll become the primary business for us,& he said, adding that this is also why he took this job.

&The company has always done a great job creating these products and the community continues to thrive,& Chandrasekar said. &But at the same time, there was a recognition that for us to really scale this in the context of a true SaaS company, you need several fundamental components we had to put in place.&

The first task was to bring in someone who had experience scaling organizations, which is why Chandrasekar was hired. He also brought on Dietrich as CPO, as well as new VP of Customer Success Jeff Justice (formerly with Dropbox), and will soon announce a new chief revenue officer. &All these components we&ve put in place so that we can actually be a high-scale SaaS company,& said Chandrasekar. &Thatreally where we&re headed.&

- Details

- Category: Technology Today

Read more: How Stack Overflow’s new CEO plans to kickstart enterprise growth

Write comment (92 Comments)

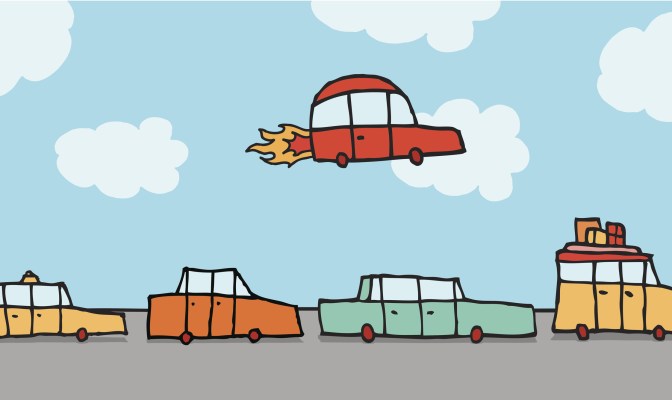

NASA and a clutch of startup and established companies are moving forward with plans to transform mobility in urban environments through the Urban Air Mobility Grand Challenge.

If itfully implemented, the new Urban Air Mobility system could enable air transit for things like package delivery, taxi services, expanded air medical services and cargo delivery to underserved or rural communities, the agency said in a statement.

The Grand Challenge series brings together companies developing new transportation or airspace management technologies, the Agency said.

&With this step, we&re continuing to put the pieces together that we hope will soon make real the long-anticipated vision of smaller piloted and unpiloted vehicles providing a variety of services around cities and in rural areas,& said Robert Pearce, NASAassociate administrator for aeronautics, in a statement.

The idea is to bring companies to collaborate and also give regulatory agencies a window into the technologies and how they may work in concert to bring air mobility to the masses in the coming years.

&Our partnership with the FAA will be a key factor in the successful and safe outcomes for industry that we can expect from conducting these series of Grand Challenges during the coming years,& Pearce said, in a statement.

Getting the agreements signed are the first step in a multi-stage process that will culminate in the challengeofficial competition in 2022. There are preliminary technological tests that will take place this year.

&We consider this work as a risk reduction step toward Grand Challenge 1,& said Starr Ginn, NASAGrand Challenge lead. &It is designed to allow U.S. developed aircraft and airspace management service providers to essentially try out their systems with real-world operations in simulated environments that we also will be flight testing to gain experience.&

Partnerships for the challenge fall into three categories:

- Developmental Flight Testing: These are industry partners providing vehicles that will fly in the challenge.

- Developmental Airspace Simulation: Companies will test traffic management services in NASA-designed airspace simulations for urban air mobility.

- Vehicle Provider Information Exchange: These partners are also working closely with NASA to provide information about their vehicles so NASA can prep them for possible flight activities that will occur during the 2022 Grand Challenge.

The Grand Challenge is managed through NASAAdvanced Air Mobility project, which was established in the agencyAeronautics Research Mission Directorate to coordinate urban air mobility activities.

Companies participating in the challenge include:

- Joby Aviation of Santa Cruz, California

- AirMap, Inc., of Santa Monica, California

- AiRXOS, Inc., of Chantilly, Virginia

- ANRA Technologies, Inc., of Chantilly, Virginia

- ARINC Inc., of Cedar Rapids, Iowa

- Avision, Inc., of Santa Monica, California

- Ellis - Associates, Los Angeles, California, a wholly owned subsidiary of Lacuna Technologies, Palo Alto, California

- GeoRq LLC of Holladay, Utah

- Metron Aviation, Inc., of Herndon, Virginia

- OneSky Systems Inc., of Exton, Pennsylvania

- Uber Technologies, Inc., of San Francisco, California

- The University of North Texas of Denton, Texas

- Bell Textron of Ft. Worth, Texas

- The Boeing Company of Chantilly, Virginia

- NFT Inc., of Mountain View, California

- Prodentity, LLC of Corrales, New Mexico

- Zeva Inc., of Spanaway, Washington

- Details

- Category: Technology Today

Uber sold its food delivery business in India to the local rival Zomato for $206 million, the American ride-hailing company disclosed in a regulatory filing in one of its key overseas markets.

In January, Uber announced that it had sold the India business of Uber Eats to Zomato for a 9.99% stake in the loss-making Indian food delivery startup. The two companies had not disclosed the financial terms of the deal, which some Indian news outlets slated to be $350 million in size. TechCrunch had reported that Uber Eats& India business — and a 9.99% stake in Zomato — was valued at about $180 million.

In the filing, Uber said the &fair value of the consideration& it received for Uber Eats& India business from Zomato was $206 million, which included $35 million of &reimbursement of goods and services tax receivable from Zomato.&

The deal underscores a significant cut in the 11-year-old Indian firmvaluation, which was reported to be worth $3 billion when it disclosed a $150 million fresh investment earlier this year.

In an interview with Indian news agency PTI in December, Zomato co-founder and chief executive Deepinder Goyal said the company was in the process of raising as much as $600 million by the end of January. The company has yet to secure the rest of the capital. A Zomato spokesperson declined to comment.

The exit of Uber Eats from India has made the local food delivery market a duopoly between Zomato and Prosus Ventures-backed Swiggy, which raised $113 million in an ongoing round last month. According to industry estimates, Swiggy is the top food delivery business in India.

Both the startups are struggling to find a path to profitability in India, however, as they continue to dish out more than $15 million each month to win new customers and keep the existing ones happy.

Finding a path to profitability is especially challenging in India, as, unlike in the developed markets such as the U.S., where the value of each delivery item is about $33, in India, a similar item carries the price tag of $4, according to estimates by Bangalore-based research firm RedSeer.

Anand Lunia, a VC at India Quotient, said in a recent podcast that the food delivery firms have little choice but to keep subsidizing the cost of food items on their platform, as otherwise most of their customers can&t afford them.

If that wasn&t tough enough, the two startups are staring at a new competitor. TechCrunch reported last week that Amazon plans to enter Indiafood delivery business by as soon as end of March.

- Details

- Category: Technology Today

Read more: Uber sold its food delivery business in India to Zomato for $206M

Write comment (91 Comments)

On a day that saw the U.S. Federal Reserve try to flip the only switch it can to light up investor confidence, investors remained unconvinced of the short-term financial prospects of the U.S. and global economies.

All three major indices saw red on Tuesday after a sharp Monday rally partially erased their historically bad week that came before. The see-saw of domestic equities continued for yet another day.

In contrast to yesterdaysharp gains on slim positive news, todaydeclines came on the back of that surprise Fed rate cut of 50 basis points — the first such unexpected reduction since the 2008 financial crisis.

While itnice of the Fed to ease some during a period of uncertainty, the fact that it is cutting rates so sharply ahead of the markettiming expectation implies that things could be worse than previously thought.

There are a host of reasons for investor pessimism. Airline travel and the attendant business spending that goes with it is being sharply curtailed by fears of spreading the COVID-19 coronavirus. No one knows the extent to which supply chain disruptions in China in the first quarter will impact supplies in the second quarter. And the U.S. has yet to fully reckon with the coronavirus& spread, nor does it have a good handle on the extent of the virus& spread within the U.S.

A true cause may be unknowable, but the effect was that stocks got whacked. Herethe butcherbill:

- Dow Jones Industrial Average: -789.37, or 2.96%

- S-P 500: -86.86, or -2.81%

- Nasdaq Composite: -268.08, or -2.99%

The anti-stonking hit techlargest players as well, with Apple falling over 3%, Microsoft falling 4.8%, Alphabet slipping 3.4%, Amazon falling a more modest 2.3% and Facebook slipping the most with a 5.4% decline during regular hours.

SaaS stocks took things particularly hard, off nearly 4% a few hours before closing, the Bessemer cloud and SaaS index wrapped the day off 2.9%, as well. Some companies didn&t take too much damage. Slack lost about a point, and Uber recovered all losses on the day to post a gain.

What could bring about a slowdown to volatility isn&t clear.

This recent market turbulence is not stopping some companies from filing to go public — we&ve seen construction software firm Procore file, along with venture-backed Accolade, just in the last week.

- Details

- Category: Technology Today

Read more: Stocks fall despite Fed intervention, dragging tech shares down once again

Write comment (99 Comments)Page 1312 of 1414

13

13