Fintech companies have been lobbying for weeks to be able to participate in the U.S.

government emergency lending program for small businesses.

Now those efforts have paid off, as PayPal, Intuit and Square have all been approved to participate in the U.S.

Small Business Administration (SBA) Paycheck Protection Program, which provides aid in the form of forgivable loans for small businesses that keep all employees on their payroll for at least eight weeks.

The $350 billion small business loan program is a part of Congress $2 trillion coronavirus stimulus package, and is aimed at those businesses with fewer than 500 employees.

PayPal on Friday announced it had been approved as one of the first non-bank institutions able to help distribute the loans under the SBA program, after having received its approval to participate in the program.

The company has already operated as a small business lender before today, it noted.

Since 2013, PayPal has provided loans and cash advances to business owners.

Those efforts, to date, have provided access to more than $15 billion in funding for over 305,000 small businesses.

&We are eager to deploy our capital and expertise to do our part in helping small businesses survive this challenging period,& said PayPal President and CEODan Schulman, in astatement.&The first loans have been applied for and issued.

We expect more loans to be issued in the coming days.

Thanks to Congressional leaders and the Administration for ensuring the CARES Act allowed companies like PayPal to help distribute funds quickly to those businesses that are most impacted,& he added.

Meanwhile, Intuit on Monday detailed several of its new programs launched in response to the COVID-19 crisis and the resulting governmental aid programs.

It debuted the latest of these efforts with the launch of Intuit Aid Assist, a free website designed to help small business owners and self-employed assess how much federal relief they&re eligible for under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, administered by the SBA.

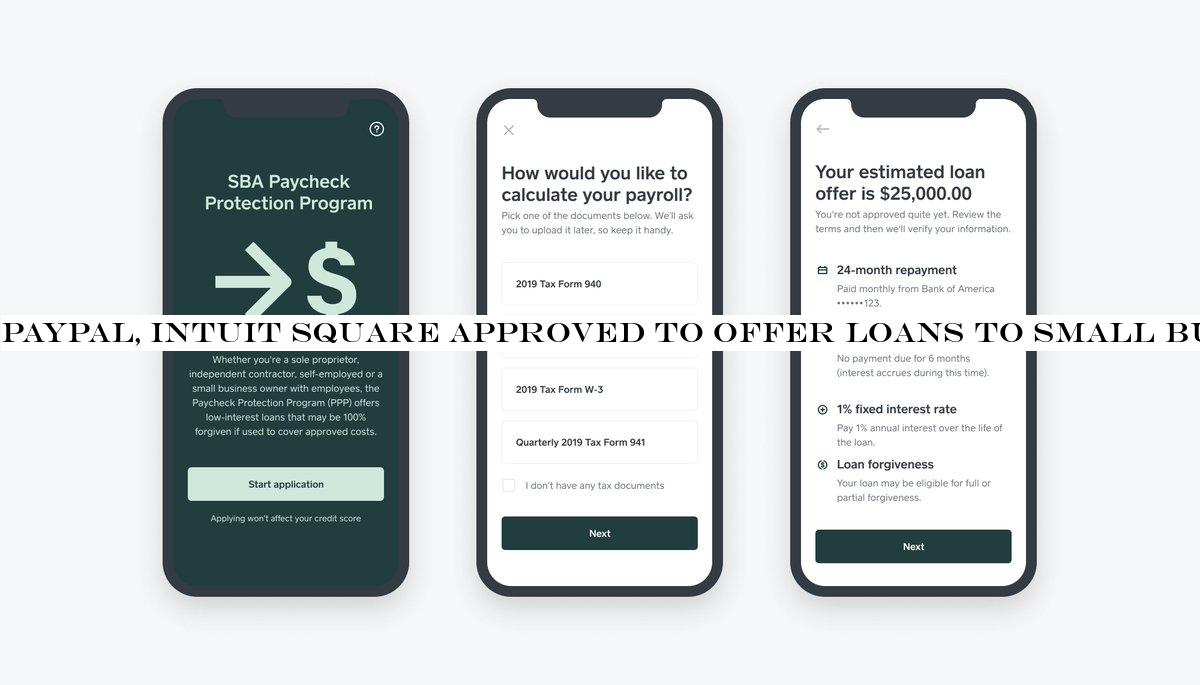

And like PayPal, Intuit QuickBooks Capital on Friday received approval as a non-bank lender for the SBA Paycheck Protection Program (PPP).With QuickBooks Capital, small business owners are able to get assistance with determining their eligibility for the federal relief.

The software simplifies the application process using automation, as well.

In coordination with the SBA, it then disburses the PPP funds, making it faster to gain access to the relief.

&Many consumers and small businesses are struggling to make ends meet and provide for their families.

They are facing a loss of income and a lack of savings to weather the storm,& said Intuit CEO Sasan Goodarzi.

&The U.S.

government has stepped in with much-needed relief and we&re partnering closely to help.

We applied our artificial intelligence and rapid innovation capabilities to help Americans navigate these offerings and get access to the relief they need quickly,& Goodarzi said.

Intuit had also recently launched Stimulus Registration, a new service from Turbo Tax aimed at helping consumers register to receive their stimulus checks from the government.

In less than two weeks& time, Intuit says more than 165,000 Americans used the service to register for more than $230 million in federal stimulus money.

Square Capital on Monday joined PayPal and Intuit with its announcement of having received SBA approval as a PPP lender.

The company said it would start rolling out its PPP loan applications this week, working in partnership with Celtic Bank.

1/4 Square Capital has received U.S.

Treasury and SBA approval to be a PPP lender, and we will start rolling out our PPP loan applications this week.

We continue to work with our partner Celtic Bank as they have existing expertise as a leading SBA lender.

— Jackie Reses (@jackiereses) April 13, 2020

Square Capital said it would notify sellers through Square Dashboard when their application is available, starting with employers whose application data can be verified automatically.

Online lenders and fintech companies have been lobbying to become authorized SBA lenders over the past few weeks.

On Thursday, the U.S.

Treasury responded by publishing a form that would allow fintech companies to apply for approval to the SBA lending program.

But the lack of approval hadn&t stopped some online fintech firms from soliciting applications from those seeking relief, NBC News recently reported.

Kabbage, for example, initially failed to note on its website it wasn&t yet an approved lender, the report said.

An alliance of fintech technology leaders known as Financial Innovation Now in March had written a letter to lawmakers that asked to participate alongside banks in the distribution of funds to small businesses.

The alliance — which includes Square, PayPal, Intuit, Stripe and others — argued they had &the reach, relationships, and digital capabilities to reach those businesses most vulnerable& in a more timely fashion than traditional financial institutions.

10

10